Industry supply-chain trackers report component lead times have surged—often by 30% or more—making accurate availability intelligence essential for procurement teams. This concise technical and sourcing-focused guide explains how to read the TRB-875-NF datasheet, which datasheet fields drive buying decisions, and how to build a sourcing report centered on availability metrics and actionable procurement steps. The piece combines specifications, measurement formulas, supplier mapping, a brief anonymized case, and prioritized checklists to support fast, defensible buys.

The article is organized into product background and must-have specs, core availability metrics and visualizations, a sourcing report methodology, a real-world procurement snapshot, and immediate and longer-term sourcing recommendations. Readers will leave with templates and a compact framework to measure supply health and reduce allocation risk for TRB-875-NF datasheet-driven purchases.

1 — Product Overview & Key Specs (Background)

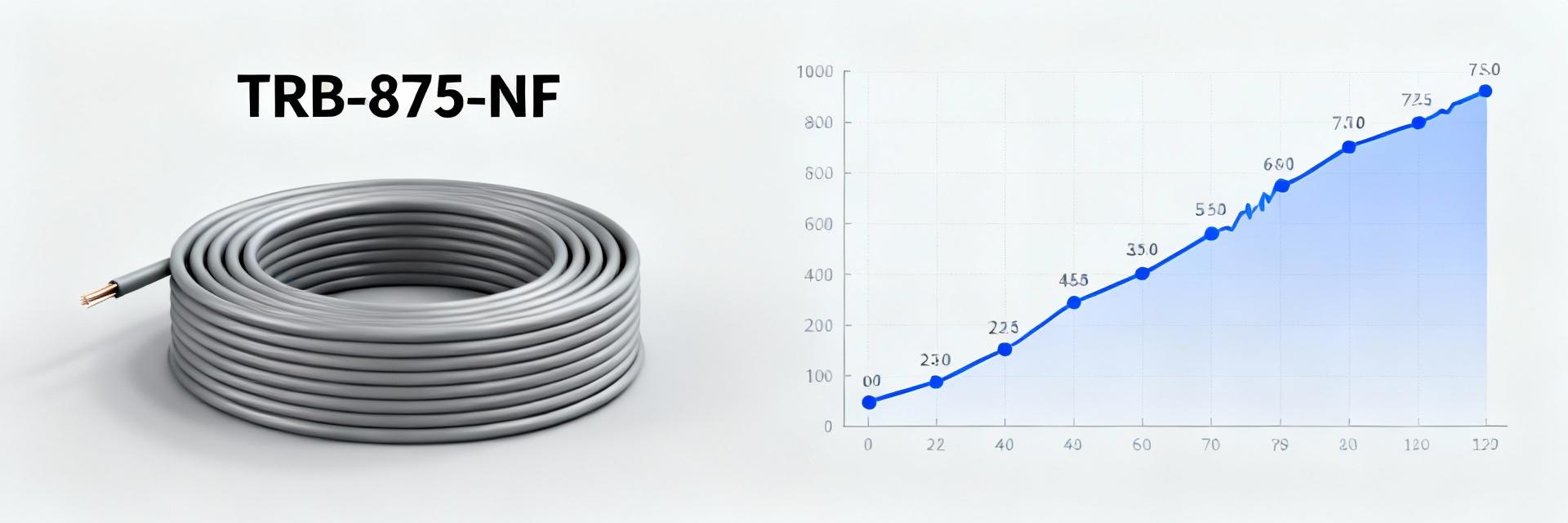

The TRB-875-NF is a radiating cable assembly designed for interior RF communications (leaky feeder) in confined infrastructure. Typical applications include in-building wireless coverage in tunnels, parking structures, and transit stations. Packaging is cable reels or cut-to-length assemblies with connectorized ends; common variants append length, connector type, or sheath options. Procurement should reference the manufacturer’s authoritative datasheet revision and product catalog for exact mechanical drawings and revision notes.

1.1 — What the TRB-875-NF is (one-paragraph summary)

The TRB-875-NF is a low-loss radiating cable optimized for UHF/VHF bands with specified VSWR and power handling. Part-number format commonly follows TRB-875-NF[-LENGTH]-[CONNECTOR], and variants include NF (no flange) and NM (micro) suffixes for connectorization. For technical confirmation always consult the manufacturer datasheet and the product catalog revision noted on that page. Key procurement stakeholders should capture revision ID and retrieval date when saving the datasheet.

ParameterValue (typ.)Notes

Frequency Range80–1000 MHzband-dependent performance

Impedance50 Ωnominal

VSWR<1.5:1typical at center bands

Power HandlingUp to 100 Wdepends on installation

Operating Temp-40°C to +85°Cenvironmental rating

PackagingReel / custom lengthsconnectorized options

1.2 — Critical specs procurement teams care about

Sourcing decisions hinge on specific datasheet fields: pinout/connector spec, voltage/current or RF power ratings, VSWR limits, temperature range, mechanical tolerances, RoHS/REACH declarations, and lifecycle / end-of-support statements. Red flags include ambiguous tolerances, missing test conditions (e.g., measurement substrate or fixture), or absent traceability statements. A short checklist for procurement: confirm revision/date, verify environmental limits, capture mechanical drawing ID, and confirm conformity declarations.

2 — Availability Metrics: How to Measure TRB-875-NF Supply Health (Data analysis)

2.1 — Core availability metrics to report

Key availability metrics to track are in-stock rate, lead time (distinguishing open-order lead time vs. production lead time), vendor on-time delivery %, minimum order quantity constraints, allocation risk, and forecasted days-of-cover. Define in-stock rate = available qty ÷ requested qty (example: 200 available ÷ 500 requested = 40%). Lead-time snapshots should capture median and 90th-percentile days. Distributor pages typically provide live available qty and lead-time quotes; manufacturers provide forecasted production lead-times and lifecycle notices—combine both sources for accuracy. The term availability metrics frames these indicators for reporting and thresholds.

2.2 — Recommended visualizations & data cadence

Effective visuals: rolling 90-day in-stock trend line, median lead time by month, vendor fill-rate heatmap, and MOQ/price scatter. Update cadence: weekly for fast-moving or allocated items, monthly for stable parts—minimum dataset: 90 days of history, current available qty, latest quoted lead time, and last five price quotes. Query authorized distributors, manufacturer availability APIs, and independent supply trackers to populate dashboards and timestamp all snapshots for traceability.

3 — Sourcing Report: Supplier Landscape & Pricing Trends (Sourcing report / Method)

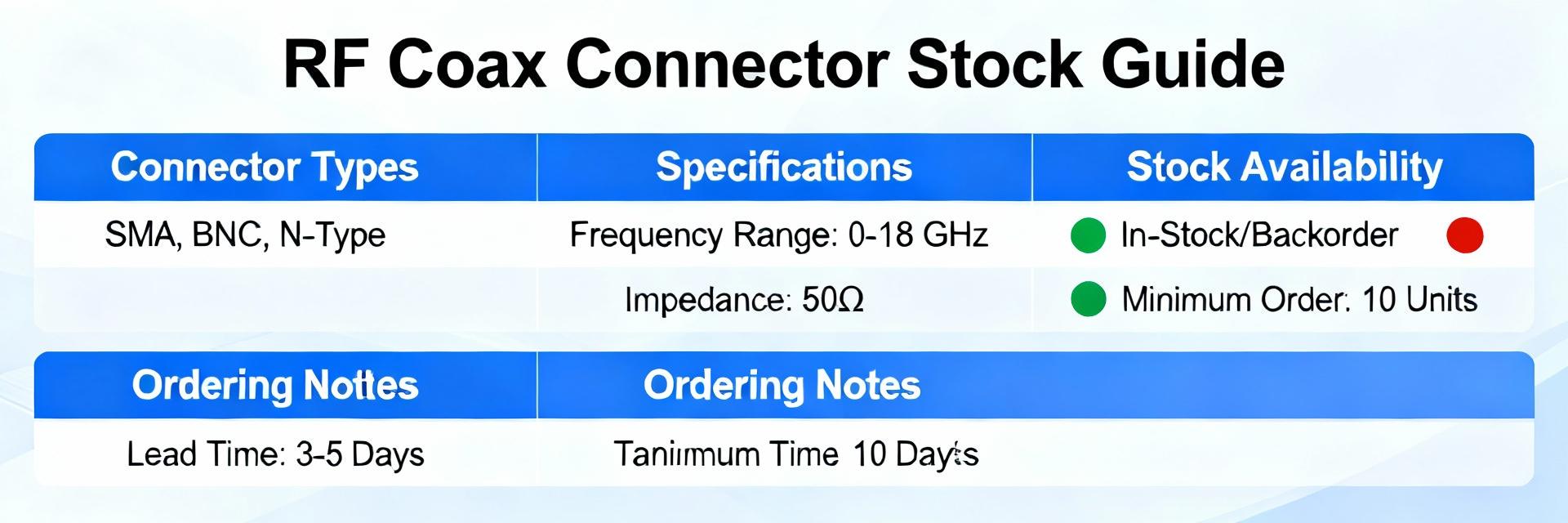

3.1 — Mapping authorized vs. aftermarket suppliers

Differentiate authorized distributors from brokers by asking for authorization statements, certificate of conformance (CoC), and lot traceability. Verification steps: request packaging photos, CoC tied to lot numbers, and proof of chain-of-custody. A sourcing report should capture supplier name, authorization status, typical MOQ, quoted lead time, last quoted price, and comments on veracity.

SupplierAuth?MOQLead TimeLast Price (USD)

Supplier AAuthorized106–8 wks$XX.XX

Supplier BBroker12 wks (stock)$YY.YY

3.2 — Pricing and lead-time trend analysis

Collect price and lead-time snapshots with timestamps, normalize terms (convert FOB to landed if needed), and detect outliers via interquartile ranges. A simple 3-point trend uses latest three quotes: if prices are $10, $11, $13, compute % change between earliest and latest: (13−10)/10 = 30% → flag if above threshold (recommend 10–20% alert band). Negotiate volume breaks by referencing normalized historical quotes and request firm lead-time commitments in contract terms.

4 — Real-World Procurement Snapshot (Case study)

4.1 — Recent procurement example (anonymized)

An anonymized buy: requested qty 500 units, authorized distributor delivered 320 units in 7 weeks, broker supplied 180 units in-stock at +25% premium and without CoC. Delivered lead time differential and a 12% price delta drove the decision to split award: secure essential quantity from the authorized source and use broker stock for immediate build. Quality checks included lot trace inspection and sample RF insertion loss verification before acceptance.

4.2 — Contingency options & substitutes

Evaluate drop-in replacements by matching critical specs: frequency performance, VSWR, impedance, and power handling. Qualification checklist: sample testing for insertion loss and VSWR across bands, mechanical fit checks, and lifecycle impact assessment. When switching sources, log lot numbers, perform incoming inspection, and run accelerated environmental tests when the application is safety- or mission-critical.

5 — Actionable Sourcing Checklist & Recommendations (Action)

5.1 — Immediate actions for buyers

Priority checklist: 1) validate the datasheet revision ID and capture retrieval date; 2) confirm at least one authorized distributor and request CoC; 3) record current availability metrics (available qty, quoted lead time); 4) place a safety-stock order sized to cover median lead time × weekly usage; 5) seek short-term contract language to lock price/lead-time. Use a standard email template requesting lot traceability and CoC for each release.

5.2 — Longer-term supply risk mitigation

Recommend multi-sourcing, consignment, vendor-managed inventory, and contractual allocation clauses. Forecasting best practices: tie safety stock to service-level targets and lead-time variability. KPIs to monitor monthly: in-stock rate < threshold (e.g., 60%), median lead time > baseline, and price increase >10% → trigger escalation to procurement leadership for sourcing review.

Summary

Verify the TRB-875-NF datasheet revision and capture exact critical specs before sourcing: frequency range, VSWR, power handling, and environmental ratings—these drive qualification and supplier selection.

Track availability metrics (in-stock rate, lead time, fill rate) with a 90-day rolling view and weekly cadence for fast-moving buys to detect allocation early and protect production.

Prioritize authorized distributors, require CoC and lot traceability, and maintain contingency plans—split awards between authorized and verified broker stock only after quality checks.

Q1: Where can I find the TRB-875-NF datasheet and which revision should I trust?

Obtain the datasheet directly from the manufacturer product catalog or the official product page and record the datasheet revision ID and retrieval date. Trust the latest manufacturer-published revision that includes mechanical drawings and test-condition notes; if a distributor provides a different revision, require a written confirmation of equivalence and a CoC before purchase.

Q2: How do availability metrics affect TRB-875-NF procurement decisions?

Availability metrics like in-stock rate and median lead time directly influence allocation risk and safety-stock sizing. Low in-stock rates or rising median lead times should trigger prioritized buys, split-award strategies, or short-term broker purchases with quality verification. Quantify days-of-cover to convert signals into procurement action.

Q3: What verification steps ensure TRB-875-NF units from a broker are acceptable?

Require a certificate of conformance tied to a lot number, packaging photos, and lot traceability. Perform incoming inspection and sample RF tests (insertion loss, VSWR) against datasheet limits. If items will support critical systems, run a defined qualification sample plan before full acceptance.