-

- Contact Us

- Privacy Policy

- term and condition

- Cookies policy

3-1478955-1 Equivalents & Stock Insights: Data Guide

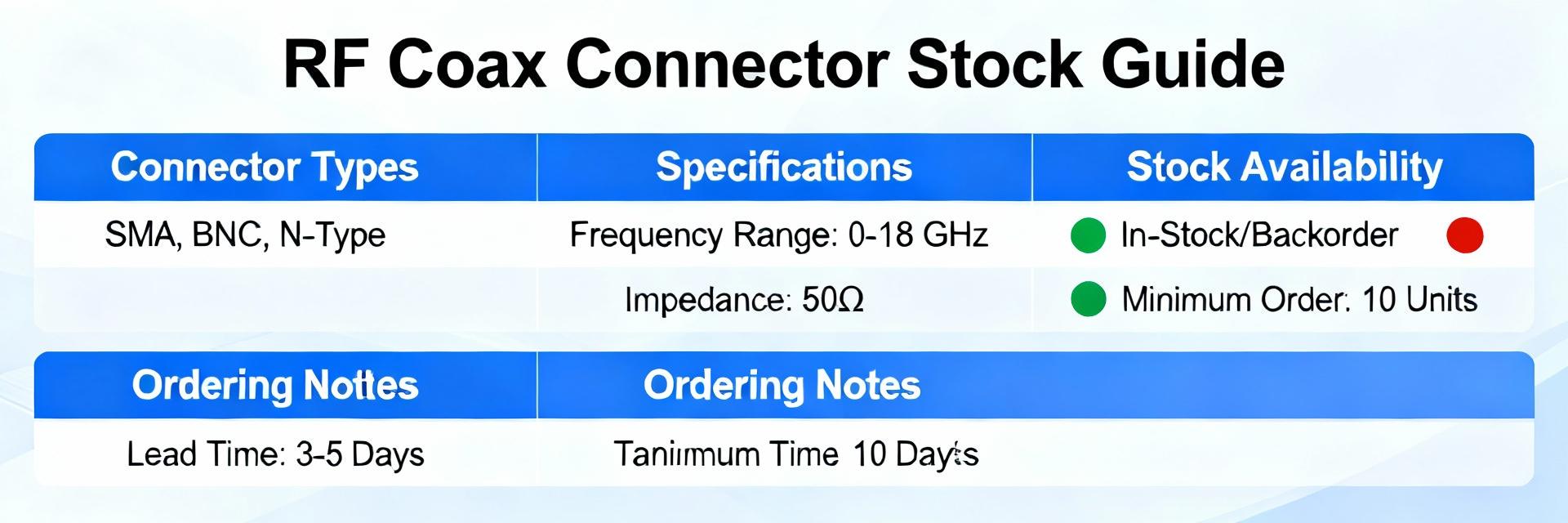

Distributor inventory snapshots this quarter show that roughly 20–30% of common coaxial connector SKUs experience intermittent out-of-stock events, driving longer lead times and premium pricing for legacy parts. This guide explains how to identify true electrical and mechanical equivalents, verify suitability, and build a monitoring and sourcing plan to mitigate stock-driven risk for mission-critical connectors.

Part overview & critical specs (background introduction)

What is 3-1478955-1: part summary and common uses

Point: The part is a board- or cable-mounted coaxial RF connector used in communications, test equipment, and embedded RF modules. Evidence: Typical form factors are right-angle or straight mating interfaces with defined impedance and mating durability. Explanation: Accurate part matching preserves signal integrity, ensures mechanical fit, and prevents premature failures when assemblies are field-deployed or integrated into RF subsystems.

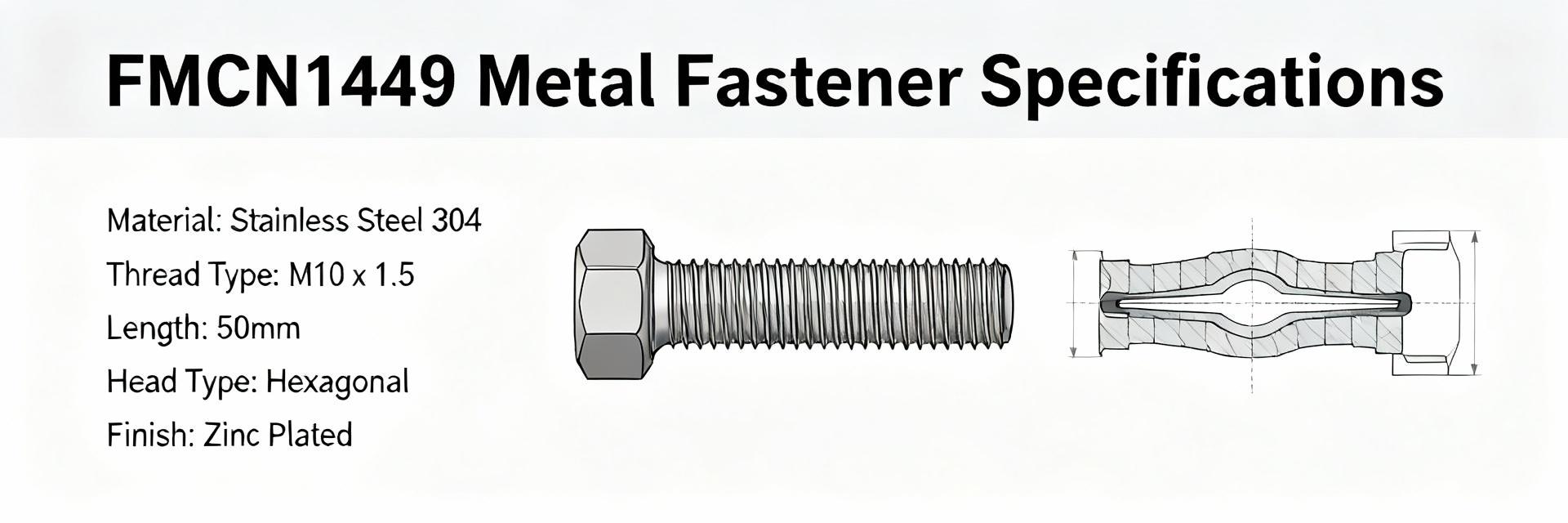

Key electrical & mechanical specs to match

Point: Only a short list of parameters determines whether a candidate is a true equivalent. Evidence: Non-negotiables include characteristic impedance, operating frequency/bandwidth, contact material and plating, mating interface geometry, mechanical footprint, mounting style, and environmental ratings. Explanation: Mismatching any of these can change VSWR, insertion loss, or create mechanical interference, so treat them as pass/fail items during equivalency screening.

| Parameter | Requirement/Why it matters |

|---|---|

| Impedance | Matched (50 Ω typical) — spectral performance depends on this. |

| Frequency/Bandwidth | Meets or exceeds system max frequency to limit insertion loss. |

| Contact Material/Plating | Gold/nickel choices affect contact resistance and corrosion. |

| Mating Interface & Footprint | Mechanical interchangeability prevents assembly rework. |

| Mounting & Temp Range | PCB, cable, or bulkhead compatibility and operating environment. |

Market & stock landscape (data analysis)

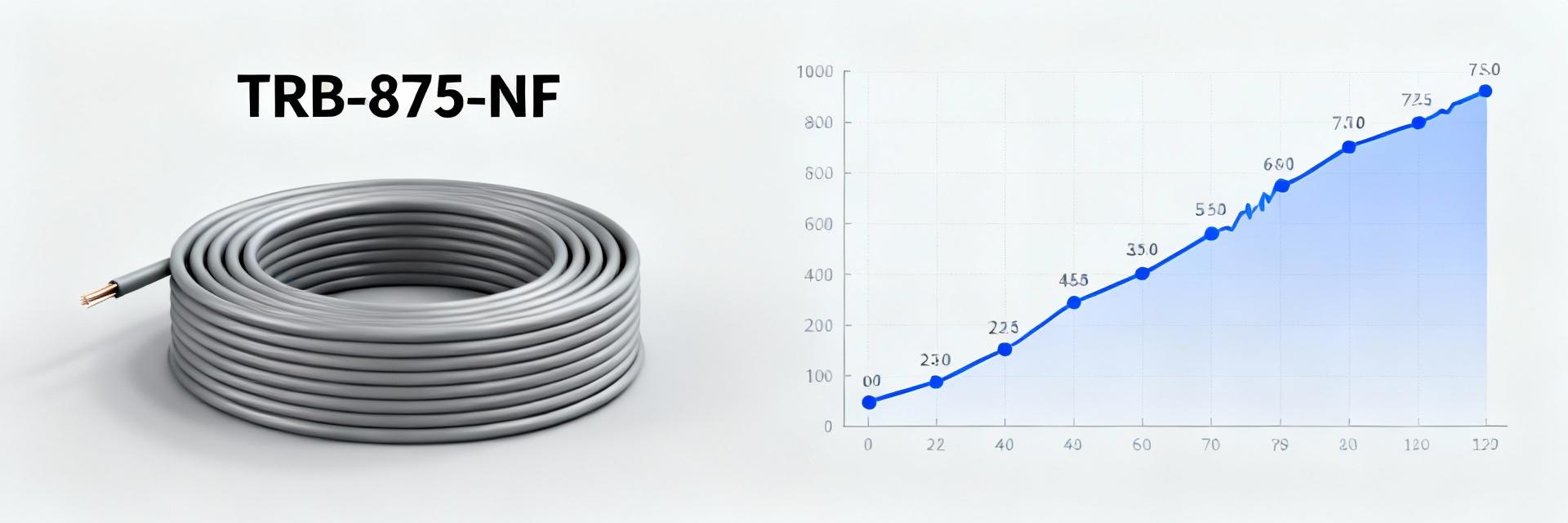

Current stock patterns & lead time indicators

Point: Stock levels for legacy coax connectors fluctuate with demand cycles and sourcing constraints. Evidence: Recent snapshots from multiple supply channels show periodic sellouts and tiered lead-time quotes; price variance often correlates with available SKU depth. Explanation: Procurement should treat availability as a live metric—use frequent snapshots and set alert thresholds for SKUs that show repeated backorder or extended lead-time signals.

Causes of shortages & historical supply drivers

Point: Shortages arise from several repeatable drivers. Evidence: Typical causes include lifecycle transitions (limited production runs), raw-material bottlenecks for specialty alloys, factory capacity shifts, and prioritized allocation for higher-volume programs. Explanation: Understanding which driver applies helps determine remedy—short-term buys, approved alternates, or long-term contracting—and frames the documentation required for qualification.

Finding and validating equivalents (method guide)

Equivalency checklist: param-by-param matching process

Point: A methodical checklist reduces substitution risk. Evidence: Steps include datasheet side-by-side checks, CAD footprint verification, electrical tolerance comparison, environmental rating confirmation, and supplier cross-reference notes. Explanation: Use a simple scoring rubric where 'must-have' items must score full pass; 'nice-to-have' items influence final choice when multiple candidates pass core checks.

Tools & resources for cross-references

Point: Efficient tool use speeds candidate identification. Evidence: Search aggregators, part cross-reference services, CAD footprint libraries, and EDA symbol repositories let teams filter by impedance, mating gender, mounting style, and frequency. Explanation: Combine aggregator results with footprint checks and supplier datasheets; maintain a short list of vetted candidates and archive cross-check evidence for audits.

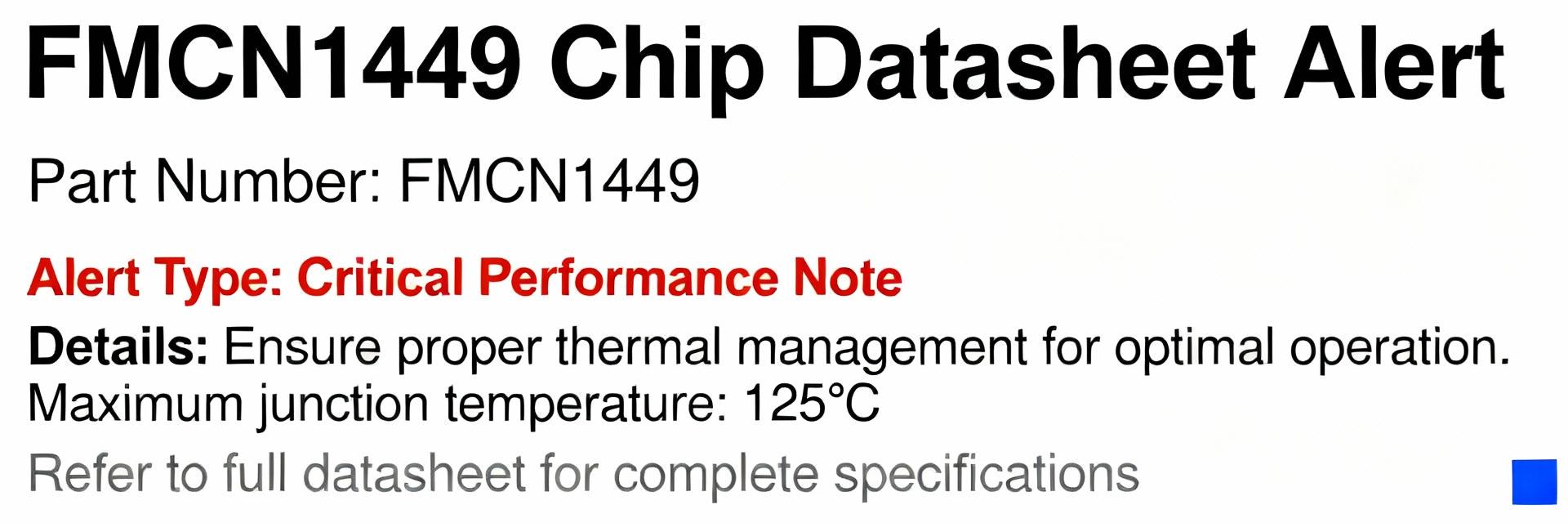

Testing, certification & risk mitigation before substitution (method guide)

Engineering validation: lab tests and in-system checks

Point: Lab validation proves real-world equivalence beyond spec sheets. Evidence: Recommended tests include continuity, return loss/impedance checks with a VNA, mechanical mating cycles, and environmental stress like thermal cycling and vibration. Explanation: Define minimum acceptance criteria (e.g., insertion loss within X dB, VSWR within Y:1) and require sample runs under target conditions before production substitution.

Compliance, traceability & warranty considerations

Point: Compliance and provenance affect long-term warranty and regulatory obligations. Evidence: Verify RoHS/REACH declarations, lot traceability, supplier QA processes, and anti-counterfeit controls. Explanation: Document decisions with supplier attestations and lot records; when liability or safety is implicated, plan for formal re-qualification or add contractual QA clauses to protect deployment timelines.

Sourcing case studies & vendor comparisons (case showcase)

Example 1: Distributor swap under time pressure

Point: Rapid swaps prioritize availability and documented equivalence. Evidence: In a typical emergency, procurement compares two candidates that pass core specs; the final choice favors shorter lead time and sample availability while meeting essential electrical and footprint checks. Explanation: Track the decision with a short report that lists rejected candidates and the pass/fail results to support future audits.

Example 2: Long-term spec-driven substitution

Point: Engineering-led substitutions emphasize performance over immediate cost. Evidence: A long-term substitute may require deeper validation (extended RF testing, lifecycle trials) and negotiated supply agreements to secure consistent quality. Explanation: Although initially costlier, this approach reduces rework and field failures for performance-sensitive products.

Actionable procurement checklist & monitoring playbook (action recommendations)

Quick-buy checklist for urgent replacements

Point: A concise checklist avoids missed steps in urgent buys. Evidence: Verify spec match, confirm MOQ and lead time, request and test samples, check returns policy, confirm lot traceability, and document approvals. Explanation: Use templated email/PO language to request lead-time confirmation and samples; require engineering sign-off on the sample test report before bulk release.

Ongoing monitoring: alerts, stocking strategies, and contract options

Point: Continuous monitoring reduces emergency buys. Evidence: Recommended tactics include automated distributor alerts, API checks, safety-stock rules, consignment or blanket contracts, and multi-sourcing for critical SKUs. Explanation: Track KPIs such as stockout days, average lead time, and price variance to trigger replenishment actions and supplier negotiations.

Summary

- Identify true equivalents by matching impedance, frequency, contact materials, mating interface, mounting footprint, and environmental ratings to protect RF performance and mechanical fit.

- Use frequent stock snapshots and automated alerts to detect early stock erosion; let availability data drive procurement choices and trigger sample validation when switching parts.

- Validate substitutes with targeted lab tests (VNA, mechanical cycles, environmental), maintain traceability, and document decisions to mitigate warranty and compliance risk.

FAQ

How should a team prioritize specs when evaluating equivalents?

Prioritize electrical and mechanical must-haves: impedance and mating interface first, then frequency bandwidth, contact plating, and footprint. Environmental and mounting requirements follow; only accept candidates that fully pass must-have checks, and use a scoring rubric for tradeoffs.

What minimal testing is reasonable before approving a substitute?

At minimum perform continuity checks, a short VNA sweep for return loss and impedance, and 100–500 mechanical mating cycles representative of expected use. Add thermal cycling if the application sees wide temperature swings; document results and acceptance thresholds.

What monitoring KPIs give the best early warning for stock risk?

Track stockout days, average quoted lead time, days of coverage vs. forecasted usage, and price variance. Set alert thresholds (e.g., lead time increase >50% or days-of-coverage

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- APT50GH120B Datasheet Deep Dive: Specs, Ratings & Curves

- APT50GH120BSC20 Power Module: Latest Performance Report

- APT50GH120BD30 IGBT: How to Maximize Efficiency for EV Drive

- GTSM20N065: Latest 650V IGBT Test Report & Metrics

- CMSG120N013MDG Performance Report: Efficiency & Losses

- GTSM40N065D Technical Deep Dive: 650V IGBT + SiC SBD

- NOMC110-410UF SO-16: Live Stock & Price Report

- 1757255 MSTBA 5.08mm PCB: Step-by-Step Install & Solder

-

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606 -

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606 -

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606 -

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606 -

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606 -

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606 -

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606 -

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606 -

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606 -

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606