-

- Contact Us

- Privacy Policy

- term and condition

- Cookies policy

FMCN1284 Stock Report: Availability, EOL & Datasheet

Introduction

Point: Recent distributor snapshots show that several RF connector SKUs from Fairview Microwave carry obsolescence flags, and FMCN1284 is appearing on multiple supplier pages with concerning lifecycle notes. Evidence: distributor listings and internal procurement observations report reduced stock, “Obsolete” annotations, and lengthening lead times. Explanation: For procurement and engineering teams, that pattern elevates supply risk, forces immediate datasheet validation, and requires a short-term sourcing playbook to avoid production interruptions.

1 — Product snapshot: FMCN1284 at a glance (background)

Point: A concise product snapshot frames the search space for replacements and BOM control. Evidence: Key identification fields and family context reduce ambiguity when cross-referencing Fairview listings and distributor SKUs. Explanation: Capturing the essential metadata up front streamlines lifecycle checks, compatibility assessment, and last-time-buy decisions without inventing electrical specifications.

Key identification data to extract from the datasheet

Point: Extracting deterministic identifier fields prevents costly misbuys. Evidence: Items such as full part number, family name, connector type, gender, impedance, recommended cable compatibility, typical frequency range, material/finish and manufacturer notes directly inform interchangeability and procurement rules. Explanation: Each field either affects electrical fit (impedance, frequency), mechanical fit (connector type, gender, dimensions), environmental suitability (material/finish, ratings), or lifecycle handling (manufacturer notes, part family). Capturing these prevents BOM drift and ensures the chosen replacement will meet system constraints.

- Capture full part number, family and connector type exactly as printed to avoid SKU mismatch when ordering.

- Record electrical parameters (impedance, frequency range) and material/finish to judge RF performance and corrosion resistance.

- Log manufacturer notes and any footnotes that mention substitutions, mating limitations, or special assembly instructions.

Typical applications and part family context

Point: Contextualizing FMCN1284 within Fairview’s product family clarifies likely use-cases and mechanical roles. Evidence: Similar Fairview RF connectors typically serve RF test equipment, cabling assemblies, and free-hanging or panel-mount connections where stable impedance and reliable mating are required. Explanation: Knowing expected applications helps engineers avoid over-specifying replacements and provides procurement a targeted search: seek parts with equivalent form-fit-function or within the same family to maximize compatibility.

- Note common uses (test rigs, interconnect cables, connectors on fixtures) to prioritize performance attributes during substitution.

- Map family variants (e.g., different cable terminations or mounting styles) to the BOM line to ensure correct mechanical mating.

- When in doubt, prefer same-family parts or vendor-recommended cross-references to reduce qualification time.

Manufacturer lifecycle status & official sources

Point: Confirming lifecycle status through authoritative channels is essential before making LTB or replacement decisions. Evidence: Typical authoritative sources include the manufacturer product page, the official datasheet PDF, and distributor lifecycle or PCN pages; these show statuses such as Active, Not For New Designs (NFND), Obsolete, or Last Time Buy (LTB). Explanation: Correctly interpreting those statuses—distinguishing “Obsolete” from “NFND” and checking for LTB windows—drives procurement timing and helps legalize last-time buy commitments.

- Verify status on the manufacturer product page and obtain the official PDF datasheet for metadata and lifecycle statements.

- Check distributor PCN/EOL listings for corroboration and capture screenshots with timestamps for the project file.

- If an EOL is indicated, contact the manufacturer or authorized rep for written confirmation and details on LTB opportunities.

2 — Current availability & distributor inventory snapshot for FMCN1284 (data analysis)

Point: A disciplined distributor inventory check reveals short-term availability and timing signals. Evidence: Distributor pages often contain stock quantity, lead time, and lifecycle annotations; snapshots can show units remaining, backorder expectations, or explicit obsolete notices. Explanation: Understanding how to capture and interpret those signals—while recording timestamps and source—lets procurement quantify risk and trigger immediate actions when thresholds are reached.

Distributor check-list & how to interpret listings

Point: Follow a consistent checklist to avoid overlooking critical listing details. Evidence: Core steps include checking major distributors and the manufacturer product page, noting stock numbers, lead-time notes, and any “Obsolete” annotations; capturing timestamped screenshots preserves the snapshot as evidence. Explanation: Distributor snapshots are not a substitute for manufacturer confirmation but are a quick triage tool that guides whether to ask for a PCN, place an LTB, or source alternates.

- Check major distributors (Digi-Key, Mouser, Farnell, TTI) and the manufacturer product page; record quantity, lead time, and status.

- Capture timestamped screenshots or exported CSVs and store them in the component risk folder for traceability.

- Prioritize follow-up with any listing that shows low stock, no incoming PO, or explicit obsolete/OBS notices.

Stock levels, lead-time signals and red flags

Point: Define measurable thresholds that indicate scarcity and trigger escalation. Evidence: Practical thresholds include zero stock with no incoming shipments, stock less than MOQ for a production batch, or rapidly increasing lead times beyond business-as-usual. Explanation: These red flags should trigger immediate procurement steps—sample buys, LTB requests, or risk-acceptance decisions—depending on production timelines and project criticality.

- Flag as critical: zero stock and no incoming PO, or remaining stock

- Escalate if reported lead times lengthen significantly (>2x typical) or if listings change status to Obsolete/NFND.

- Document observed trends (e.g., stock dropping across multiple distributors) and add to the component risk register.

EOL / PCN evidence & validation workflow

Point: A short validation workflow reduces the risk of acting on incorrect EOL signals. Evidence: Steps should include locating a formal PCN or EOL notice, confirming effective dates, checking for LTB windows, and obtaining written confirmation from Fairview or an authorized distributor. Explanation: The documentary trail—PCN, email from a rep, distributor notice—forms the basis for procurement decisions, accounting, and potential warranty or compliance actions.

- Search for a PCN/EOL on the manufacturer site and request written confirmation from the authorized rep if not explicit online.

- Record EOL effective dates and any LTB or replacement part suggestions in the project file.

- If a formal EOL cannot be located but multiple distributors mark the part obsolete, treat it as high-risk and escalate for confirmation.

3 — How to verify the FMCN1284 datasheet & technical fit (methods / guide)

Point: Verifying the authoritative datasheet and metadata prevents misinterpretation during replacement qualification. Evidence: Authoritative sources typically include the manufacturer’s OEM PDF and validated distributor datasheet copies; secondary validation can be performed via CAD libraries and internal footprint databases. Explanation: Saving a dated copy, logging the URL and retrieval date, and reconciling datasheet drawings with CAD reduces rework and ensures interchangeability.

Where to find the authoritative datasheet and metadata

Point: Use a hierarchical approach to source authenticity. Evidence: Primary sources are the manufacturer OEM PDF and product page; authorized distributors’ datasheet links serve as corroboration; internal CAD libraries and verified component databases act as secondary validation. Explanation: Always save a dated PDF and record retrieval metadata so future audits can reference the exact spec set used during qualification.

- Primary: download the OEM datasheet PDF from the manufacturer’s product page and save it with a retrieval date in the component folder.

- Secondary: corroborate with distributor datasheets and internal CAD or library records to confirm dimensions and notes.

- Log the source, filename, and retrieval date in the BOM change record for traceability.

Datasheet items to validate for electrical and mechanical fit

Point: Focus on parameters that affect interchangeability and system performance. Evidence: Key checks include mechanical outline and mating dimensions, impedance rating, VSWR/insertion loss if provided, environmental ratings, and recommended cable/assembly instructions. Explanation: If any of these items differ between candidate parts, additional validation testing or minor mechanical redesign may be necessary before approving a substitution.

- Validate mechanical outline, mating depth, and key dimensions against CAD with tolerance checks to ensure physical compatibility.

- Confirm impedance and RF parameters (VSWR, insertion loss) to maintain signal integrity; if missing, plan bench RF tests.

- Check environmental and material specs to ensure durability in the intended application (e.g., plating, temperature range).

Cross-checking footprints, drawings and procurement SKUs

Point: Cross-checks prevent misalignment between mechanical design and purchased parts. Evidence: Compare datasheet outline drawings to the PCB/CAD models and validate procurement SKUs against the exact configuration (e.g., cable termination, panel mount vs. free-hanging). Explanation: Use version control for CAD and BOM updates and document replacement rationale so revisions are auditable and reversible if issues arise.

- Overlay datasheet outline drawings on CAD models and perform tolerance checks before committing to a replacement.

- Update part numbers and CAD libraries atomically—record old vs new revision identifiers in version control.

- Require procurement SKUs to match the validated configuration (gender, termination style, material) before ordering samples.

4 — Case study: A sourcing scenario for FMCN1284 (real-world playbook)

Point: A real-world scenario helps operationalize the checklist. Evidence: Example: a distributor marks a part Obsolete but shows 12 units remaining and no incoming stock; this generates a time-sensitive decision. Explanation: The recommended flow balances immediate needs (sample purchase, LTB) against longer-term risk mitigation (authorized alternates, engineering validation).

Example snapshot: distributor shows “Obsolete” but small stock remains

Point: Small remaining stock with an Obsolete tag is a typical high-risk scenario. Evidence: With 12 units left and no incoming shipments, production needs beyond that quantity are not supported; the listing’s Obsolete annotation signals end of replenishment. Explanation: The immediate action is to secure sample units and begin LTB discussions while preparing alternate sourcing plans and risk assessment for production continuity.

- Purchase remaining stock for immediate needs and test samples to confirm fit and performance.

- Request written confirmation of EOL from the manufacturer and inquire about LTB windows and minimum quantities.

- Begin parallel identification of authorized alternates or approved secondary-market sources.

Procurement actions taken: last-time buy vs alternative sourcing

Point: Procurement must weigh LTB against alternate sourcing. Evidence: LTB locks in price and supply for a defined window, while authorized secondary markets or cross-references may carry higher risk and variable quality. Explanation: The buyer should prioritize an LTB when the part is critical, confirm writeable terms, and only use secondary sources with documented traceability if LTB is infeasible.

- If critical, place an LTB with documented terms and delivery schedule; capture the vendor confirmation in the project file.

- If LTB is not available or cost-prohibitive, evaluate authorized distributors or certified secondary sources with inspection requirements.

- Document risk acceptance decisions and contingency plans (e.g., redesign timelines) with stakeholders.

Engineering actions taken: validate replacements & minimize redesign time

Point: Engineering should quickly narrow replacements to candidates requiring minimal rework. Evidence: Actions include bench validation (mechanical fit, RF bench tests), tolerance comparisons, and assessing whether minor mechanical rework will be sufficient instead of a full redesign. Explanation: A structured validation checklist accelerates qualification and reduces the chance of late-stage failures that cause production delays.

- Run a short validation plan: mechanical fit check, RF insertion loss/VSWR test, and environmental spot checks.

- Prioritize drop-in or form-fit-function alternatives and document any required minor CAD adjustments.

- If redesign is necessary, scope the change and obtain schedule and cost estimates to compare against LTB costs.

5 — Practical checklist & recommended next steps (action suggestions)

Point: A pragmatic checklist assigns short-, medium- and long-term actions to constrain risk. Evidence: Immediate procurement, short-term engineering mitigation, and longer-term redesign or substitute planning cover operational needs. Explanation: Following a prioritized checklist reduces ambiguity and ensures both procurement and engineering move in concert to protect production schedules.

Immediate procurement checklist (24–72 hours)

Point: Short-term procurement actions stabilize the supply picture. Evidence: Concrete tasks include documenting distributor screenshots, requesting PCN/EOL confirmation, placing LTB if warranted, and checking alternate authorized suppliers. Explanation: These steps provide the documentary foundation and immediate quantities required to keep projects moving while longer-term options are evaluated.

- Document distributor snapshots with timestamps and save them to the component risk folder.

- Request formal PCN/EOL confirmation from Fairview or an authorized rep and ask about LTB windows.

- Place immediate sample orders or LTBs if the part is critical; log actions in the component risk register.

Short-term engineering mitigation (1–4 weeks)

Point: Engineering must validate fit and performance quickly to enable short-run production. Evidence: Actions include pulling the datasheet, performing quick fit-checks, prototyping with available stock, and preparing CAD changes if required. Explanation: Rapid prototyping and focused test plans minimize qualification time and allow teams to select the best path—consume remaining stock or approve a substitute.

- Retrieve and timestamp the datasheet, and run quick fit checks against CAD; order samples for bench testing.

- Prepare minor CAD changes in a branch; maintain version control and rollback procedures.

- Create a short RF test plan (mechanical fit, insertion loss/VSWR spot checks, basic environmental test) for candidate parts.

Longer-term strategy (redesign / approved substitute plan)

Point: Reduce single-source risk and prepare for future lifecycle shifts. Evidence: Options include adopting a qualified substitute with documented cross-reference, designing for alternate connector families, and adding lifecycle clauses to future BOMs. Explanation: Institutionalizing these strategies lowers future disruption risk and spreads sourcing across multiple suppliers or connector families.

- Qualify an approved substitute with documented cross-reference tests and update the approved supplier list.

- Architect future designs to accept mechanical adapters or alternate connector families to reduce single-supplier dependence.

- Add lifecycle clauses and notification requirements to future procurement contracts and BOMs.

Summary

- FMCN1284 shows obsolescence indicators across distributor listings; capture datasheet metadata and lifecycle notices immediately to assess risk and order samples if critical.

- Use distributor snapshots plus manufacturer PCN/EOL confirmation to decide on last-time buys; document all confirmations and store timestamped evidence.

- Engineering should validate mechanical and RF fit quickly using a short test plan and favor same-family or drop-in alternatives to minimize redesign.

FAQ — Common questions about FMCN1284 availability and datasheet verification

How should procurement verify an FMCN1284 EOL notice?

Point: Verification requires authoritative documentation. Evidence: The recommended workflow is to locate a formal PCN or EOL notice on the manufacturer’s site, corroborate with distributor lifecycle pages, and obtain written confirmation from an authorized representative. Explanation: Store the PCN, confirmation email, and distributor screenshots with timestamps in the project file to support LTB or sourcing decisions.

What immediate steps should engineering take if FMCN1284 stock is low?

Point: Engineering must prioritize fit and rapid testing. Evidence: Actions include pulling the datasheet, ordering available samples, performing mechanical fit checks and basic RF tests, and preparing quick CAD revisions if necessary. Explanation: This approach identifies whether remaining stock can be used or a close substitute will be required, balancing schedule and qualification risk.

When is a last-time buy appropriate for FMCN1284?

Point: LTB is appropriate when the part is critical and no suitable qualified replacement exists within the project timeline. Evidence: If the part is required for a committed production run and alternates require significant redesign or longer qualification, an LTB secures supply and mitigates immediate risk. Explanation: Always document LTB terms, delivery schedule and the approval authority, and weigh LTB cost versus redesign timeline and long-term supportability.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

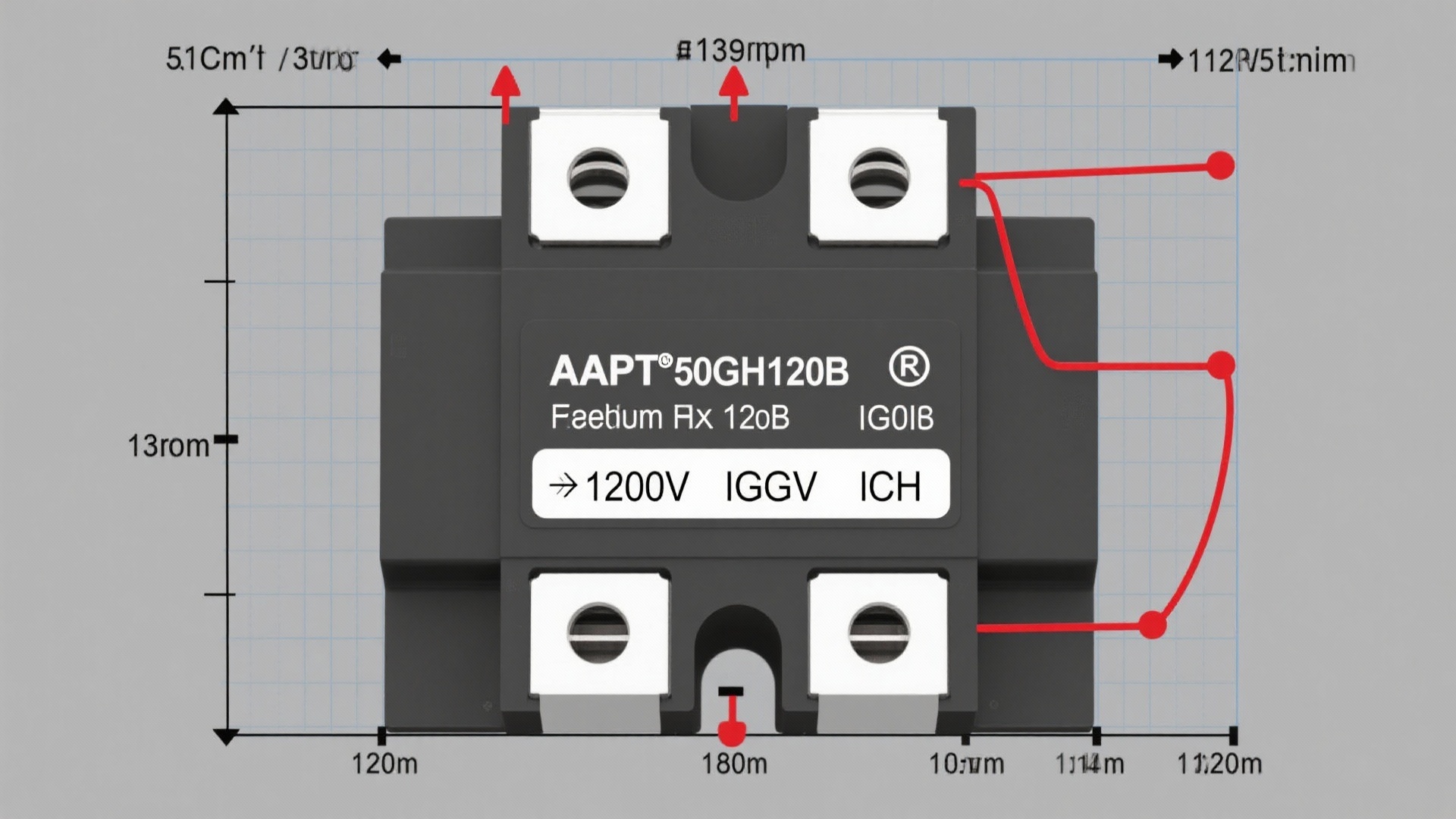

- APT50GH120B Datasheet Deep Dive: Specs, Ratings & Curves

- APT50GH120BSC20 Power Module: Latest Performance Report

- APT50GH120BD30 IGBT: How to Maximize Efficiency for EV Drive

- GTSM20N065: Latest 650V IGBT Test Report & Metrics

- CMSG120N013MDG Performance Report: Efficiency & Losses

- GTSM40N065D Technical Deep Dive: 650V IGBT + SiC SBD

- NOMC110-410UF SO-16: Live Stock & Price Report

- 1757255 MSTBA 5.08mm PCB: Step-by-Step Install & Solder

-

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606 -

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606 -

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606 -

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606 -

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606 -

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606 -

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606 -

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606 -

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606 -

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606