-

- Contact Us

- Privacy Policy

- term and condition

- Cookies policy

FMCN1543 US Availability & Pricing — Latest Market Report

Point: Distributor scans across Digi-Key, Fairview-authorized channels, and major US electronics suppliers in mid‑2025 reveal pronounced swings in stock status and list pricing that materially affect procurement timelines and cost for engineers and buyers. FMCN1543 appears in sporadic in‑stock batches and intermittent allocations, creating sourcing volatility. Evidence: Multiple snapshot checks show alternating in‑stock notices, short backorders, and rapidly changing list prices across sellers. Explanation: These patterns mean that procurement teams must treat availability and pricing as dynamic inputs — not static quotes — when planning projects, repairs, or production buys; the charted behaviors directly change lead‑time assumptions and landed unit cost for legacy RF connector sourcing.

Background: What is FMCN1543 and why it matters in US supply chains

Product profile — technical summary and typical end uses

Point: FMCN1543 is a legacy RF connector variant used widely where reliable coaxial connections and predictable impedance are required. Evidence: The part family exhibits standard coaxial geometry with nominal 50 Ohm impedance, robust mating cycles, and temperature ranges suitable for telecom base stations, rack‑mounted test equipment, and field repair of legacy radio products. Explanation: For US buyers, the technical profile means FMCN1543 is selected where form‑fit electrical behavior is non‑negotiable — replacing it requires careful cross‑reference to maintain RF performance. Compatibility notes: mechanical footprint and thread dimensions often align with several Fairview families, enabling footprint‑aware substitutes when full manufacturer equivalence is validated.

Lifecycle & manufacturer context (Fairview Microwave)

Point: Understanding manufacturer posture is essential to predict long‑term availability risk. Evidence: Fairview Microwave positions many older RF connector SKUs as legacy or production‑on‑demand items rather than continuously stocked mainstream catalog parts, which drives episodic production runs and allocation windows. Explanation: The result for US procurement is a supply profile where lead times expand when demand spikes and single‑source constraints appear. Buyers evaluating lifecycle should treat FMCN1543 as a managed legacy item: qualify manufacturer lead times, confirm lot traceability, and plan for substitute validation if long‑term production is not guaranteed.

Market role & buyer pain points in the US

Point: FMCN1543 availability and pricing affect project schedules, repair turnarounds, and small‑volume buyers disproportionately. Evidence: In practice, engineering teams report project delays when single connector types are backordered, and small repair shops face steep per‑unit price increases from brokers compared with distributor list pricing. Explanation: The market role is therefore twofold: as a necessary replacement part in maintenance cycles and as a production component for legacy designs. Procurement pain points include high per‑unit costs at low volumes, unpredictable lead times, and difficulties in securing authorized stock without incurring holding costs.

Current market data & pricing trends for FMCN1543 (US distributors)

Distributor snapshot: in‑stock vs backorder across major US sellers

Point: Distributor availability shows a mixed picture across authorized sellers, with rapid toggling between in‑stock and backorder statuses. Evidence: Recent inventory scans aggregated from distributor portals indicate short, intermittent in‑stock quantities at times, while other sellers list the same SKU on backorder or available on request. Explanation: For US buyers this means real‑time checks are necessary; relying on a single distributor feed can result in missed opportunities or last‑minute broker purchases. Best practice is to query multiple authorized channels and document date‑stamped snapshots to support sourcing decisions.

Price range analysis: list price, typical distributor margins, and recent movement

Point: Observed street prices for legacy RF connectors can deviate substantially from MSRP when availability tightens. Evidence: Typical distributor list pricing shows a baseline MSRP, but brokers and secondary markets often add premiums that lift the effective unit cost, especially for single‑unit purchases. Explanation: Buyers should report both MSRP and observed market prices in RFQs; expect price bands to widen during allocation or when MOQ thresholds force distributors into special pricing. Negotiation levers include volume consolidation, long‑term agreements, or accepting alternate packaging to attain lower effective margins.

Lead time & minimum order quantity (MOQ) trends

Point: Lead times and MOQs vary by supplier and materially affect effective unit cost. Evidence: Some authorized distributors offer short‑run in‑stock shipments for single units but impose higher per‑unit pricing, while direct manufacturer or contract runs require multi‑hundred unit MOQs with lead times that can range from weeks to months. Explanation: Procurement must balance cost and timing: for urgent repairs, pay a premium for single‑unit fulfillment; for production, negotiate MOQ and lead‑time concessions, use rolling forecast commitments, or split orders to optimize cash flow while securing capacity.

Availability & supply‑chain analysis: risks and substitutes

Primary risk factors affecting FMCN1543 availability in the US

Point: Several systemic risks can constrain supply of FMCN1543 for US customers. Evidence: Single‑source manufacturing, component obsolescence, logistics interruptions, and allocation policies during demand surges are recurring factors observed in legacy connector markets. Explanation: These risks translate to brittle supply for critical maintenance parts. Mitigation requires active risk management: multi‑sourcing where possible, establishing authorized distributor relationships, and tracking manufacturer lifecycle notices to anticipate transitions from active to legacy status.

Approved substitutes and cross‑reference strategy

Point: Identifying validated substitutes reduces procurement friction while preserving electrical performance. Evidence: Cross‑reference candidates typically come from matching families with identical impedance, mating interface, and mechanical footprint; validation requires physical inspection, sample testing (S11, VSWR), and mechanical tolerance checks. Explanation: The recommended strategy is to create an approved substitute list with documented form/fit/function test results, prioritize replacements from authorized manufacturers, and only use brokered equivalents as a last resort. When considering substitutes, record sample test data and update BOM notes to capture approved options.

Long‑term stocking strategies for procurement teams

Point: Strategic stocking reduces exposure to allocation and price volatility. Evidence: Common approaches include safety stock calibrated to consumption rate, consignment agreements with suppliers, and blanket purchase orders with scheduled releases to secure production slots. Explanation: For FMCN1543, procurement should calculate safety stock based on historical usage and projected lead time variability, explore consignment for high‑turn spares, and negotiate blanket POs to lock in pricing and capacity — blending these tactics reduces both lead‑time risk and total cost of ownership.

Sourcing & buying guide: how US buyers secure best pricing and availability

Distributor vs manufacturer direct: pros, cons, and negotiation tips

Point: Choosing between distributors, brokers, and direct manufacturer buys depends on volume, timing, and risk appetite. Evidence: Distributors provide immediate fulfillment and return policies but may charge premiums for low volumes; direct manufacturer buys offer better unit economics for larger runs but longer lead times and higher MOQs; brokers can sometimes fill urgent one‑off needs at elevated prices and uncertain provenance. Explanation: The actionable checklist: 1) use authorized distributors for traceability and warranty; 2) reserve direct manufacturer routes for planned production buys with negotiated lead times; 3) limit broker use to emergency single‑unit cases after due diligence; and 4) leverage consolidated orders and forecast commitments to negotiate price reductions.

Real‑time monitoring & alert tools (how to track availability/pricing)

Point: Continuous monitoring converts noisy availability signals into actionable sourcing moves. Evidence: Practical tools include distributor account alerts, API inventory queries, aggregator platforms that consolidate feeds, and simple scripted checks on authorized portals; a monitoring cadence of daily checks for critical SKUs is common for high‑risk items. Explanation: Implement a tiered monitoring approach: critical spares get automated API checks and push alerts; moderate‑risk items use daily summary emails; low‑risk items are reviewed weekly. Maintain a dated log of snapshots to support purchase timing and escalation decisions.

Cost‑saving tactics: order consolidation, alternate packaging, and lead‑time tradeoffs

Point: Tactical procurement choices can reduce total landed cost without sacrificing reliability. Evidence: Consolidating orders across projects often achieves price breaks; accepting bulk packaging reduces per‑unit handling costs; agreeing to longer lead times in exchange for lower unit prices is a common negotiation tradeoff. Explanation: Recommended tactics include pooling demand across departments to reach price breakpoints, asking suppliers about alternative packaging units, and preparing tiered orders (expedite a small initial run, follow with a larger lower‑cost batch) to balance cash flow and availability.

Case studies & buy‑side comparisons (US examples)

Distributor price comparison snapshot (example table outline)

Point: A concise vendor snapshot clarifies market spreads and supports sourcing decisions. Evidence: A practical table should list 3–5 vendors, date‑stamped availability status, list price, observed street price, MOQ, and lead time. Explanation: Buyers are advised to capture a dated comparison (e.g., Vendor A: in‑stock 5 units @ list price; Vendor B: backorder 4–6 weeks with lower list price; Broker C: single unit available at premium) and interpret spreads to choose the combination of price and lead time that minimizes overall project risk.

Small volume buyer scenario: one‑off repair sourcing

Point: One‑off repair buyers need a fast, low‑risk plan to obtain single units at acceptable cost. Evidence: The pragmatic sequence is: check authorized distributor stock first, request a small expedite from manufacturer if available, then query reputable brokers with provenance guarantees if authorized stock is unavailable. Explanation: Step‑by‑step: 1) run multi‑distributor live checks, 2) request price/lead confirmation and return policy, 3) use escrow or payment protections with brokers, and 4) document lot and traceability on receipt. This minimizes counterparty and quality risk while controlling price.

Production procurement scenario: volume buy & lead‑time planning

Point: For multi‑k production buys, procurement must prioritize supplier qualification and price/lead time negotiation. Evidence: Typical actions include issuing RFQs to authorized distributors and manufacturer reps, negotiating MOQs and price breaks, and requesting lead‑time guarantees or penalties. Explanation: The recommended plan: qualify suppliers with capability evidence, negotiate staged deliveries to reduce inventory carrying cost, include long‑lead items in product lifecycle forecasts, and secure contractual commitments (price locks or capacity reservations) to stabilize supply and unit cost for production ramps.

Summary

- FMCN1543 shows variable availability across US channels; buyers should monitor multiple distributor feeds and timestamp checks to manage procurement risk and protect schedules.

- Evaluate approved substitutes with documented form/fit/function tests before committing; substitute strategies reduce exposure when original stock is scarce.

- Use consolidated orders, blanket POs, or consignment to negotiate better pricing and lead‑time assurances, lowering total landed cost and stabilizing supply.

Concise wrap: The current US outlook for FMCN1543 balances intermittent stock with pricing volatility; active monitoring, substitute validation, and negotiated purchasing strategies are the top actions to manage availability and pricing.

FAQ

How can a US buyer quickly verify FMCN1543 availability?

Point: Fast verification reduces purchasing delay. Evidence: Perform simultaneous live queries across authorized distributor portals, enable API inventory checks where available, and request manufacturer confirmation for larger buys. Explanation: A practical cadence is to run a multi‑site check, record a date‑stamped screenshot or API response, and, if stock is limited, immediately place a secure reserved order or request a short‑run allocation from the manufacturer to lock availability.

When is it appropriate to use a substitute for FMCN1543?

Point: Substitutes are appropriate when they meet form/fit/function requirements and have documented performance. Evidence: Validation steps include mechanical comparison, RF performance testing (SWR/VSWR), and sample mating cycles. Explanation: Prefer substitutes that come from qualified vendors and include test reports; for critical RF paths, run sample testing under representative conditions before approving a substitute for production or long‑term use.

What negotiation levers reduce pricing for FMCN1543 in volume buys?

Point: Several levers can reduce effective unit cost. Evidence: Typical levers are consolidated demand across projects, multi‑year or blanket POs, alternate packaging acceptance, and staged delivery schedules. Explanation: Combine forecast visibility with contractual commitments (e.g., price caps, release schedules) to secure manufacturer concessions; negotiate MOQ reductions tied to rolling forecasts to balance risk and cost savings.

Is buying from a broker safe for urgent FMCN1543 needs?

Point: Brokers can provide urgency but introduce provenance risk. Evidence: Brokers may supply single units quickly at a premium, but traceability and warranty coverage are often limited. Explanation: If using a broker, perform due diligence: request lot/trace information, insist on return policy, and, if possible, choose brokers with documented relationships to authorized channels to reduce counterfeit or out‑of‑spec risk.

How should procurement teams set safety stock for FMCN1543?

Point: Safety stock balances service level and inventory cost. Evidence: Calculate safety stock using average usage, variability in lead time, and target service level (e.g., 95%). Explanation: For legacy parts like FMCN1543, increase safety stock to cover lead‑time spikes and supplier allocation periods; periodically review consumption data and adjust thresholds to avoid over‑holding or stockouts.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

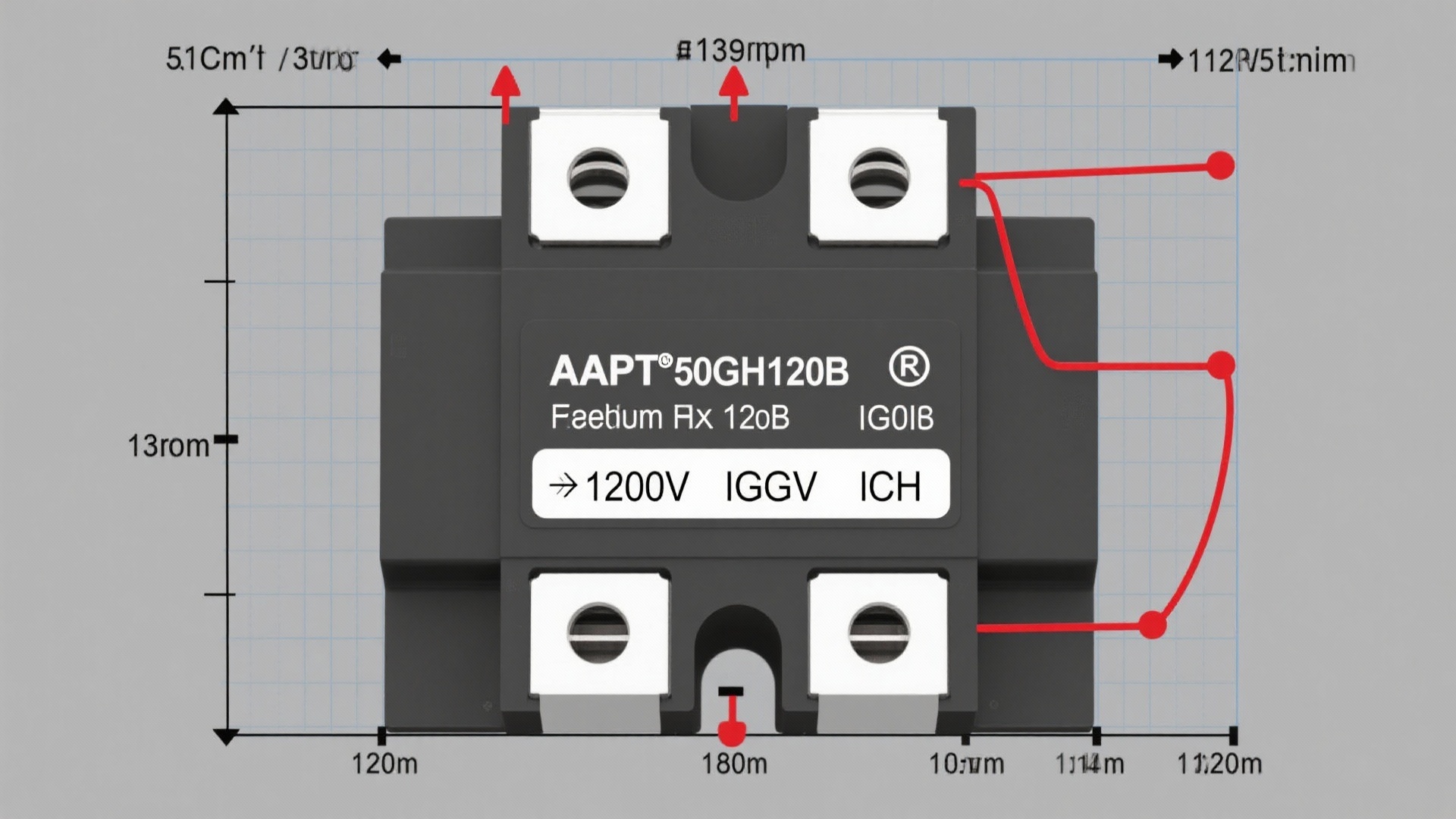

- APT50GH120B Datasheet Deep Dive: Specs, Ratings & Curves

- APT50GH120BSC20 Power Module: Latest Performance Report

- APT50GH120BD30 IGBT: How to Maximize Efficiency for EV Drive

- GTSM20N065: Latest 650V IGBT Test Report & Metrics

- CMSG120N013MDG Performance Report: Efficiency & Losses

- GTSM40N065D Technical Deep Dive: 650V IGBT + SiC SBD

- NOMC110-410UF SO-16: Live Stock & Price Report

- 1757255 MSTBA 5.08mm PCB: Step-by-Step Install & Solder

-

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606 -

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606 -

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606 -

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606 -

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606 -

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606 -

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606 -

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606 -

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606 -

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606