Prediction hook: Over the next few years engineering teams will face accelerated change in board- and wire-to-board interfaces driven by higher power density, tighter packaging, and tougher field validation requirements. Early part choices determine rework risk; selecting a part with balanced electrical, mechanical and environmental margins avoids costly redesign. This article focuses on the 5-1814813-0 option and practical actions engineers should take now to align footprint, thermal headroom, and validation plans with projected system loads.

1 — Why 5-1814813-0 Matters Now (Background introduction)

What the 5-1814813-0 connector is and where it's used

Point: The part class is a compact wire-to-board family commonly specified for low- to mid-power interconnects in constrained spaces. Evidence: Typical implementations use 2–12 pins with keyed housings for polarity and locking. Explanation: Applications include power distribution on consumer devices, power modules in industrial controls, and internal harnesses in compact appliances where space, current-carrying ability, and secure retention are primary concerns; a simple block diagram shows system power -> harness -> mating board header -> load.

Key physical and electrical baseline specs to note

Point: Datasheet reading should start with a short prioritized spec list. Evidence: Critical specs are pitch, pin count, rated current per contact, voltage rating, contact plating, and housing material. Explanation: These baseline specs determine PCB routing density, trace width needs, thermal derating, and compatibility with automated assembly; capture them in a one-column snapshot for quick cross-team review.

Spec

Typical Value / What to check

Pitch

3.0–5.08 mm — dictates PCB density

Pin count

2–12 — match harness and power paths

Rated current

3–10 A per contact — verify derating curve

Voltage rating

12–250 V — ensure clearance/creepage

Contact plating

Au or tin — watch for fretting/corrosion

Housing material

PA66/UL94 V-0 or better — check temp and flammability

2 — Industry Trends & Standards Shaping Connector Requirements (Data analysis)

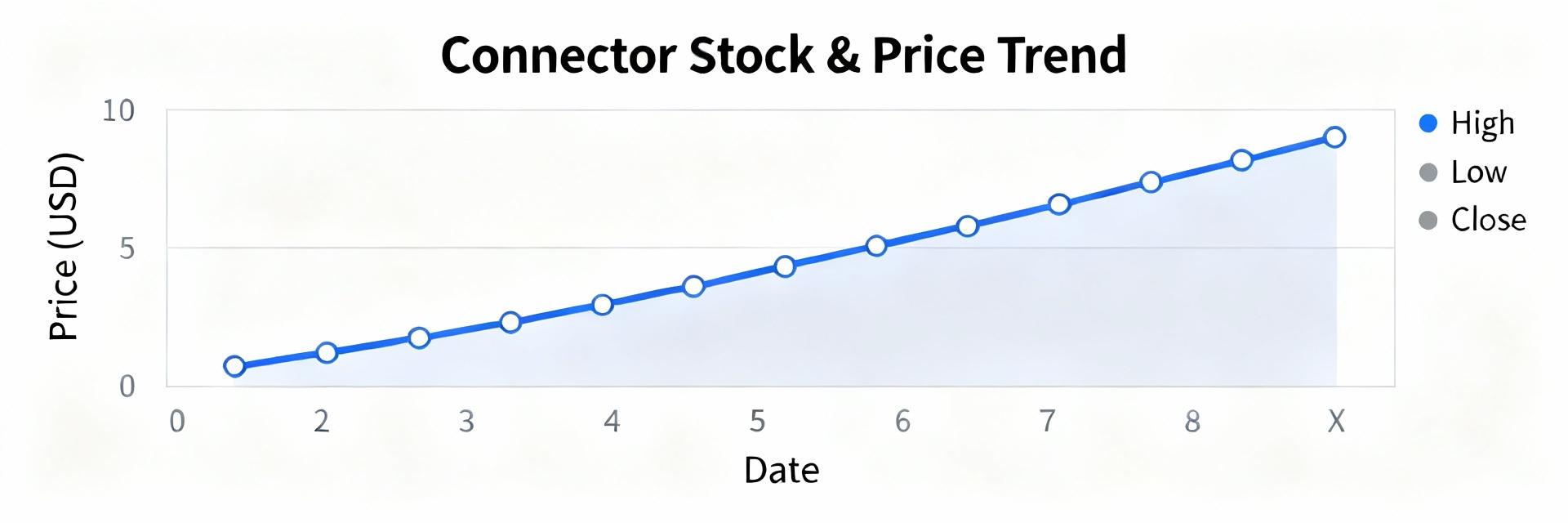

Market & engineering trends affecting connector selection

Point: Several trends change how connector specs are prioritized. Evidence: Miniaturization reduces pitch and available PCB area; higher power density pushes current per contact upward; automated assembly expects tighter dimensional tolerances; field reliability demands higher temp and corrosion resistance. Explanation: Each trend maps to measurable spec impacts — smaller pitch -> tighter footprint tolerances; higher power -> higher temperature rating and thicker contacts; automation -> tighter mechanical tolerances; field reliability -> plating and sealing choices.

Miniaturization → stricter footprint tolerances and creep/clearance checks.

Higher power density → choose contacts with higher current capacity and plan derating curves.

Automation → require dimensional callouts and pick-and-place compatibility.

Field reliability → specify plating, housing material, and IP/salt-fog needs.

Regulatory and test-standard shifts to monitor

Point: Standards and environmental directives continue raising baseline requirements. Evidence: Flammability ratings, RoHS-like material restrictions, and salt-fog/IP classifications directly alter acceptable materials and finishing. Explanation: In a datasheet, expect changed notes under flammability class, material declarations, and environmental test tables; align procurement and validation checks to these spec lines early to avoid late substitutions.

3 — 5-1814813-0 Specs Deep-Dive: Electrical, Mechanical & Environmental (Data analysis / technical)

Electrical specifications engineers must verify

Point: Electrical validation should go beyond the nominal rated current. Evidence: Verify rated current per contact, voltage withstand, contact resistance, insulation resistance, and derating curves; include inrush scenarios and expected pulse currents. Explanation: Recommended thresholds: contact resistance 1 GΩ, and verify derating such that continuous current at max ambient remains within thermal rise limits; plot current vs. temperature to set design limits.

Mechanical and environmental performance criteria

Point: Mechanical endurance and environmental robustness determine field life; check 5-1814813-0 specs for these metrics. Evidence: Key items are insertion/extraction force, mating cycles, vibration/shock ratings, operating temperature, humidity/salt-fog resistance, and sealing. Explanation: Suggested acceptance:

4 — Design, Assembly & Validation Tips (Method guide + action recommendations)

PCB footprint, routing, and mechanical integration best practices

Point: Early CAD discipline prevents late rework. Evidence: Specify footprint tolerances, keep-out and stiffening zones, and thermal relief on high-current traces. Explanation: CAD checklist: verify pad size ±0.1 mm, define keep-out for mating retention, add PCB stiffener or vias under header for mechanical load, route high-current traces with proper width and copper thickness; include a footprint verification step in DFM review.

Confirm pad geometry and solder mask openings against mechanical drawing.

Allocate thermal relief or planes for current carrying paths.

Specify mounting reinforcement for harness strain relief.

Assembly, inspection and reliability test plan

Point: A focused test plan catches common failure modes early. Evidence: Solder profile (if applicable), crimp quality, AOI/X-ray, and accelerated life tests are typical checkpoints. Explanation: Prioritized validation sequence: prototype bench tests → environmental stress (thermal cycling, humidity, salt-fog) → pilot run electrical endurance. Watch for contact fretting, plating wear, and increased insertion force as common failure modes.

5 — Real-World Upgrade Example: Migrating to 5-1814813-0 (Case study)

Assessment & selection criteria used in the migration

Point: Migration decisions balance mechanical fit and electrical margin. Evidence: Compare legacy vs. new on mechanical fit, electrical load, environmental margin, and lead-time risk. Explanation: Use a checklist template that scores footprint interference, derating margin at expected ambient, retention force, and procurement risk to make an objective selection.

Checklist: mechanical clearance, pin mapping, current margin, temperature margin, assembly compatibility, procurement lead time.

Validation outcomes and practical lessons learned

Point: Track measurable outcomes to justify the migration. Evidence: Typical metrics are contact resistance after cycles, insertion force change, and thermal rise at rated current. Explanation: Document measured values against acceptance thresholds and include corrective actions (e.g., select alternate plating, add PCB reinforcement) and requalification triggers when any metric drifts beyond limits.

Metric

Initial

After 500 cycles

Accept

Contact resistance

12 mΩ

14 mΩ

Insertion force

3.2 N

3.6 N

Thermal rise @ rated current

18°C

22°C

Conclusion (summary + action checklist)

Summary: Prioritize electrical headroom and mechanical retention early, align validation to projected future loads, and follow a staged verification path before volume builds. Practical action: validate derating curves, lock down footprint in first PCB spin, and run targeted environmental and endurance tests to avoid late rework. The 5-1814813-0 choice can simplify migration when these steps are followed and documented.

Validate rated current and derating early in design.

Confirm footprint and mechanical retention in the first PCB spin.

Run targeted environmental and endurance tests before pilot production.

Document acceptance thresholds for contact resistance, insertion force, and thermal rise.

Keep a versioned validation report to speed future part swaps.

Key summary

Early-spec capture: Record pitch, pin count, rated current and housing material in a single spec snapshot to align electrical and mechanical teams; this reduces late-stage disagreement and speeds DFM checks.

Validation-first approach: Plot current vs. temperature derating and set acceptance thresholds for contact resistance and thermal rise; include endurance cycles and salt-fog where field exposure is likely.

Integration checklist: Lock footprint tolerances, add PCB stiffening and strain relief, and run a prioritized validation sequence (bench → environmental → pilot) before volume runs to prevent rework.

Frequently Asked Questions

What electrical specs should be checked first for a connector?

Check rated current per contact, voltage withstand, contact and insulation resistance, and any derating curves first. These determine trace widths, copper thickness, thermal rise expectations, and whether the part meets continuous and inrush load conditions.

How should designers verify mechanical retention and mating life?

Run insertion/extraction force measurements at assembly and after specified mating cycles, perform vibration and shock tests per product requirements, and record any force increase or contact resistance drift; acceptance should be defined before pilot production.

Which environmental tests are most informative for field reliability?

Thermal cycling, humidity/temperature soak, and salt-fog (if exposed) are high-value tests. Combine these with electrical endurance and contact resistance monitoring to reveal plating or housing material weaknesses under realistic stress.