-

- Contact Us

- Privacy Policy

- term and condition

- Cookies policy

BNC 75Ω 6-1337549-0 Availability & Pricing Outlook

Recent US distributor snapshots and procurement searches show tightening availability and upward pricing pressure for the BNC 75Ω connector part 6-1337549-0. Point: buyers face lead-time risk and BOM cost increases. Evidence: procurement signals and low on-hand snapshots. Explanation: this article gives an objective, data-driven outlook and actionable sourcing steps to reduce program risk and margin impact.

(1) Product & Market Snapshot — BNC 75Ω 6-1337549-0 (background introduction)

Product specs & typical applications

Point: the part is a 75-ohm BNC coaxial jack in a panel/mount form used where controlled impedance is required. Evidence: typical electrical specs include 75 Ω nominal impedance and RF-capable frequency ranges; mounting and termination define the exact variant. Explanation: this variant is specified for broadcast, CCTV and test equipment because of its mounting style, gender and solder/termination option.

Market footprint & buyer profile in the US

Point: primary US buyers are contract manufacturers, test labs and systems installers ordering program-driven lots. Evidence: orders often come as MTO batches, spares and seasonal replenishment. Explanation: single-sourcing and concentration of program demand produce volatility; large MTO spikes or retrofit programs create short-run demand that stresses availability for this connector family.

(2) Data Analysis: Availability Trends & Pricing Movements (data analysis)

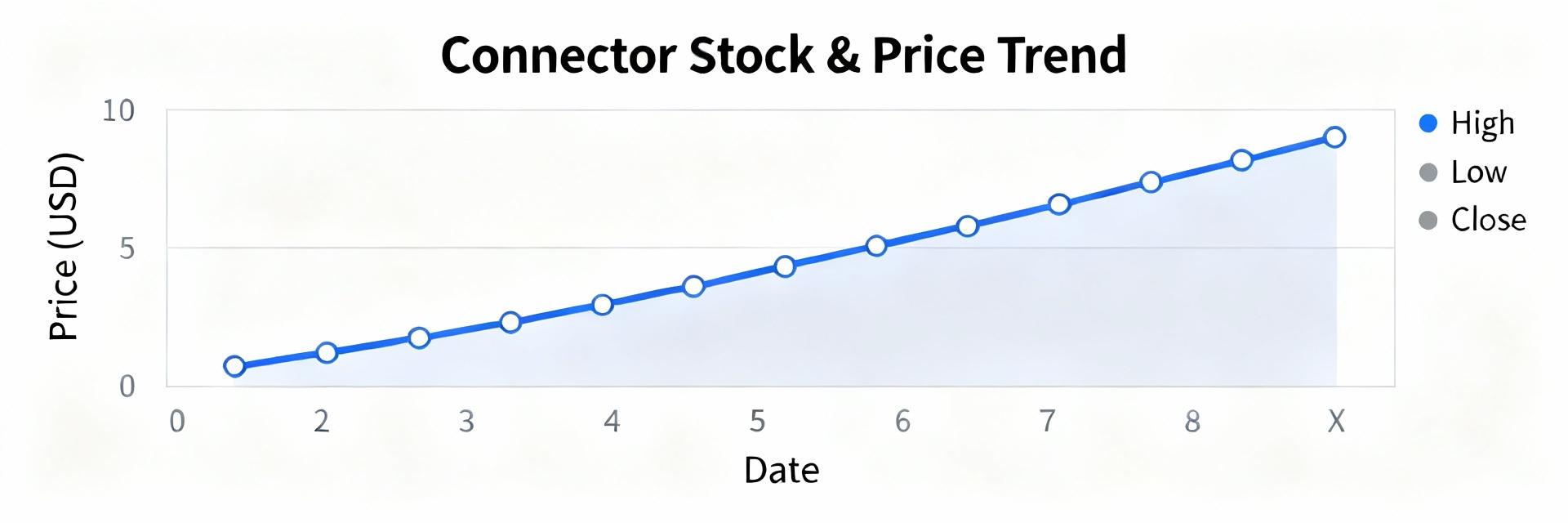

Inventory & lead-time indicators to collect

Point: procurement should track distributor stock levels, days of supply, average lead times and quoted ETAs across 30/90/180-day windows. Evidence: flags include falling days-of-supply, frequent ETA revisions and low multi-source coverage. Explanation: assembling a compact table of current stock, 30/90/180-day change and lead-time variance quickly highlights tightening availability for the part.

Price trend drivers and near-term outlook

Point: price movement is driven by commodity costs, manufacturing capacity, demand spikes and logistics. Evidence: rising raw material or freight indices and constrained fab capacity typically presage increases. Explanation: frame scenarios as stable, rising or volatile and define trigger points (e.g., >10% freight increase, lead-time >12 weeks) to decide protective buys or re-pricing clauses.

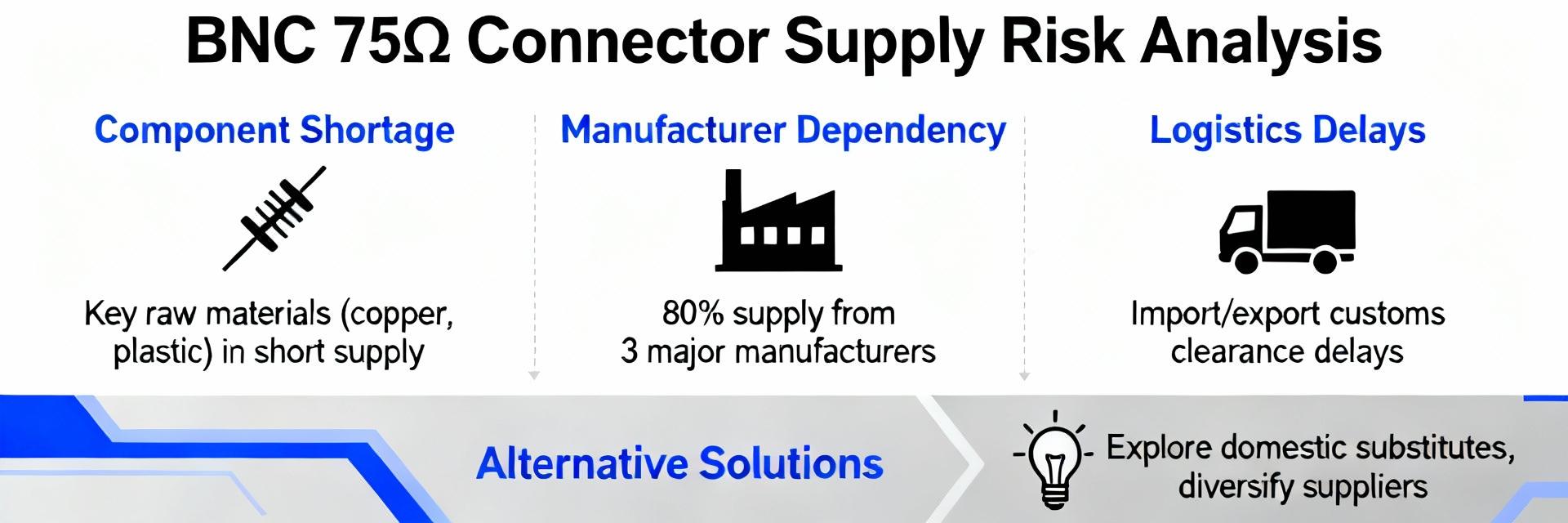

(3) Supply-Chain Analysis & Risk Assessment (data + method)

Common supply constraints and risk mapping

Point: common constraints include single-source manufacturing, MOQ limits and seasonal capacity bottlenecks. Evidence: score inputs such as lead-time variability, MOQ, and supplier concentration to categorize risk. Explanation: use a three-level risk matrix (Low / Medium / High) and score 6-1337549-0 on those inputs to prioritize mitigation actions for high-risk lines.

How to validate real-time availability in the US

Point: validating live availability requires a disciplined procurement cadence. Evidence: steps include multi-source checks, issuing RFQs, requesting firm quotes with ship dates and confirming ETAs by email. Explanation: cross-check distributor snapshots against supplier confirmations and require firm commitments to avoid stale stock claims and last-minute short shipments.

(4) Alternatives & Sourcing Strategies (method guide / case-style)

Interchange parts, footprint-compatible substitutes, and specification trade-offs

Point: identify footprint-compatible BNC 75Ω alternates and compare impedance, VSWR, mounting and materials. Evidence: acceptable substitutes match mechanical footprint and electrical performance within qualification margins. Explanation: include test plans for signal integrity and requalification costs; substituting without verification can degrade RF performance and increase validation cycles.

Sourcing playbook for buyers (short-, mid-, long-term)

Point: a tiered sourcing playbook reduces risk across horizons. Evidence: short-term tactics include protective buys and expedited freight; mid-term tactics include staggered orders and multiple approved vendors; long-term tactics include design-to-availability and qualified alternates. Explanation: negotiate volume breaks, lead-time clauses and consignment where possible and assign owners in procurement, engineering and operations for each tactic.

(5) Pricing Impact & Procurement Action Checklist (action recommendations)

Cost modeling & BOM impact scenarios

Point: model per-unit price changes to quantify margin impact. Evidence: prepare sensitivity scenarios (+5%, +15%, +30%) and compute delta on product cost and gross margin for typical order sizes. Explanation: collect inputs—current unit cost, average order quantity, and target margin—to run a short spreadsheet and present finance with scenario outputs for approval of protective buys.

Immediate actions for US buyers (30/60/90-day plan)

Point: a prioritized 30/60/90-day checklist accelerates mitigation. Evidence: actions include verifying current inventory, requesting firm quotes, qualifying alternates, placing protective buys, and negotiating staggered deliveries. Explanation: assign owners—procurement to run RFQs, engineering to qualify alternates, operations to confirm safety-stock—and set deadlines for each step to reduce lead-time and price risk.

Conclusion / Summary (10–15%)

Point: current data indicate constrained availability and upward pricing pressure for the BNC 75Ω part; buyers should validate live availability, model pricing impact, and implement the sourcing checklist. Evidence: tightening stock snapshots and lead-time variance drive this assessment. Explanation: follow the outlined validation, risk-scoring and sourcing playbook to protect schedules and margins.

Key Summary

- Constrained availability for the BNC 75Ω family is visible in distributor snapshots; buyers should verify live stock and ETAs before committing production schedules.

- Price pressure is driven by materials, capacity and logistics; run sensitivity scenarios (+5% to +30%) to quantify BOM and margin impact for planning.

- Mitigation: multi-distributor checks, qualifying footprint-compatible alternates, protective buys and staggered deliveries reduce lead-time and cost risk.

Frequently Asked Questions

How quickly can procurement verify availability for 6-1337549-0?

Procurement can validate availability within 24–72 hours by running multi-source stock checks, issuing RFQs with firm ship dates and requesting written ETA confirmations. Follow-up phone or email confirmation and a short audit of days-of-supply across sources reduce the chance of stale stock claims and provide a defensible purchase decision.

What are acceptable electrical checks when substituting for 6-1337549-0?

When substituting, acceptable checks include impedance verification (75 Ω), insertion loss, VSWR across the operational band and mechanical footprint comparison. Create a minimal lab test: continuity, return-loss sweep and mechanical fit. Document results and estimate requalification time and cost before approving any replacement for production use.

How should finance and procurement model a +15% price increase on 6-1337549-0?

Finance should take current unit cost, multiply by 1.15 for a +15% scenario, then propagate the delta across BOM quantities to calculate total cost increase and margin erosion. Include freight and duty sensitivity, and present break-even and passthrough options. Use this to justify protective buys or price renegotiations with customers.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- APT50GH120B Datasheet Deep Dive: Specs, Ratings & Curves

- APT50GH120BSC20 Power Module: Latest Performance Report

- APT50GH120BD30 IGBT: How to Maximize Efficiency for EV Drive

- GTSM20N065: Latest 650V IGBT Test Report & Metrics

- CMSG120N013MDG Performance Report: Efficiency & Losses

- GTSM40N065D Technical Deep Dive: 650V IGBT + SiC SBD

- NOMC110-410UF SO-16: Live Stock & Price Report

- 1757255 MSTBA 5.08mm PCB: Step-by-Step Install & Solder

-

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606 -

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606 -

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606 -

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606 -

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606 -

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606 -

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606 -

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606 -

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606 -

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606