-

- Contact Us

- Privacy Policy

- term and condition

- Cookies policy

89K401-272N1 Stock & Price Snapshot — Current Availability

As of the latest distributor listings in Dec 2025, one live listing shows 4,557 units of the Rosenberger panel jack in stock and public price snippets cite roughly $26.69–$29.26 per unit. This data-driven snapshot explains what the part is, where stock currently sits, how price varies between sellers, and the exact steps a US buyer should follow to verify availability and secure parts.

The figures reported here reflect a moment-in-time assembly of distributor inventories and reseller quotes; readers must re-check live distributor pages and quotes before issuing purchase orders. The methodology below outlines how to compile and verify counts, plus a verification workflow and procurement checklist tuned for US buyers seeking minimal lead time and traceability.

1 — Product & market background

Product overview (what to include)

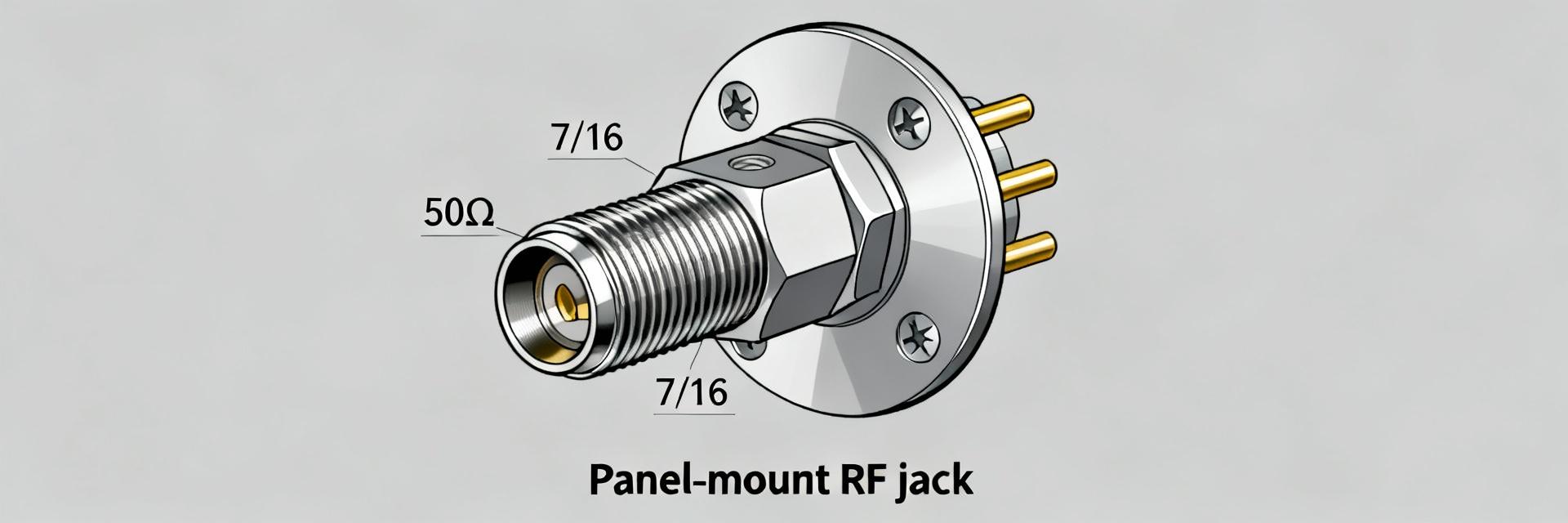

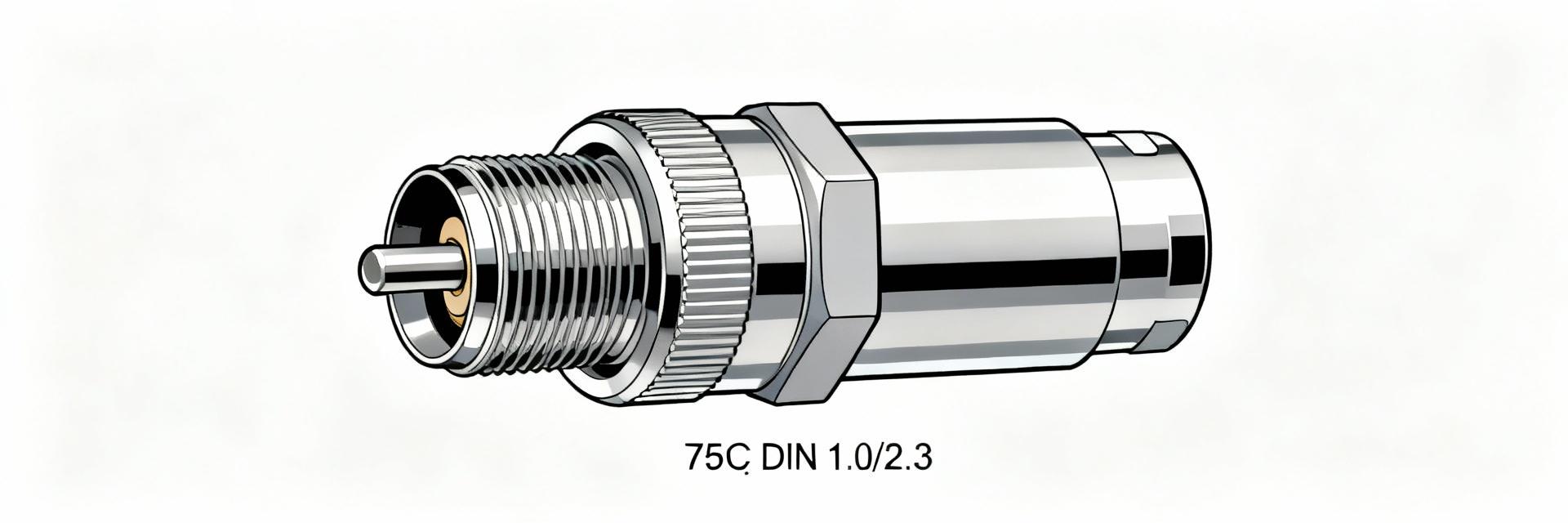

Point: The item is a Rosenberger NEX10-style panel jack designed for RF/coaxial interconnects in test equipment, racks, and compact RF modules. Evidence: Typical specifications include a panel-mount bulkhead form factor, NEX10 mating interface, and solder or crimp rear termination options. Explanation: Engineers select this family for dense RF layouts where low profile and consistent impedance are required; include synonyms such as NEX10 PANEL JACK and Rosenberger panel jack when searching inventories or datasheets.

Why availability matters for buyers

Point: Availability materially affects production continuity and aftermarket support. Evidence: Long lead times, lifecycle transitions, or limited production runs raise risk; distributor inventory pages and manufacturer bulletins are primary signals. Explanation: For production runs and repairs, on-hand stock reduces schedule risk; for prototypes, short-term procurement from authorized stocks or trustworthy brokers speeds validation while minimizing counterfeit or obsolete risks.

2 — Live stock data overview

Consolidated stock snapshot (how to compile)

Point: Aggregate live counts from authorized distributors, tiered resellers, and marketplace listings to form a consolidated snapshot. Evidence: Compile seller, SKU, quantity on hand, last-updated timestamp and location; note that one listing currently reports 4,557 pcs in stock. Explanation: Use a rolling spreadsheet that captures timestamped screenshots or emailed quotes to preserve proof of availability; replace placeholder numbers with fresh checks before a PO.

Regional distribution & lead-time signals

Point: US buyers should prioritize domestic stock to cut transit time and customs friction. Evidence: Listings marked “in stock” from US warehouses typically ship in days, while offshore stock often shows “available in X weeks.” Explanation: Evaluate seller location, shipping origin, and stated earliest ship date; prefer sellers showing US-based fulfillment or reliable expedited freight quotations for urgent orders.

3 — Price analysis & trend drivers

Current price range & quoted examples

Point: Observed public unit prices fall in a roughly $26.69–$29.26 band, with variance by seller and quantity. Evidence: Snippets and quick quotes show mid-to-high twenties per unit; bulk tiers and MOQs can materially lower unit cost. Explanation: Report unit price alongside MOQ, bulk tiers, and estimated landed cost (shipping, duties, brokerage). Always request a written quote with expiry to lock tiered pricing for the PO window.

What moves the price (supply drivers)

Point: Multiple factors drive price differences between sellers. Evidence: Primary drivers include order quantity, currency/exchange fluctuations, lead-time premiums, broker margins, and scarcity due to lifecycle status. Explanation: Procurement should request landed cost for comparison, ask for price breaks at common MOQs, and factor in expedited shipping or inspection fees when comparing apparent unit prices.

4 — Where to buy & verification checklist

Authorized distributors vs brokers: pros and cons

Point: Authorized distributors offer traceability while brokers can fill short-term gaps at variable risk. Evidence: Trust signals for authorized sellers include manufacturer authorization statements, consistent datasheet delivery, and visible lot/date-code policies; broker risk markers include vague datasheets, evasive traceability answers, and mismatched photos. Explanation: Favor authorized distributors for production and high-value builds; use vetted brokers only with dated photos and COA/traceability requirements documented in the PO.

Step-by-step stock & price verification workflow

- Search manufacturer’s authorized distributor list and two tier-1 resellers for live inventory snapshots.

- Request dated, packaged photos showing part, quantity, and date code; capture seller page screenshots with timestamps.

- Ask for COA or traceability when required and confirm packaging and warranty conditions.

- Obtain a written quote with explicit expiry, MOQ, unit price, and shipping terms; request landed cost.

- Confirm payment terms and acceptable inspection/returns language before issuing PO.

- Stagger orders if supply is limited: place a reserve PO and follow with replenishment releases.

5 — Distributor snapshots & procurement action plan

Quick distributor cards (example fields)

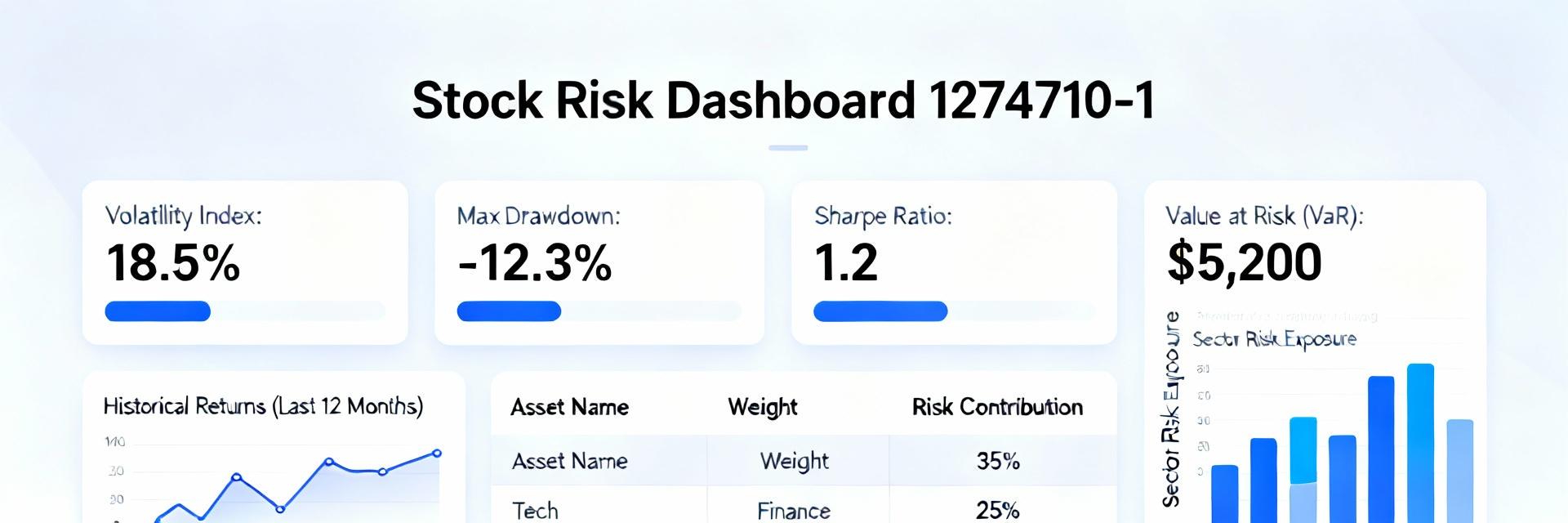

| Seller | SKU | Qty on hand | Unit price | MOQ | Lead time | Location | Trust signals |

|---|---|---|---|---|---|---|---|

| micro‑semiconductor (placeholder) | 89K401-272N1 | 4,557 | ~$26.69 | 1 | Immediate (US warehouse) | US | Manufacturer listing, dated inventory |

| safe‑ic (placeholder) | 89K401-272N1 | varies | ~$29.26 | 10 | 2–3 weeks | Offshore | Broker; request COA |

5-step buyer checklist to secure parts

- Verify seller authenticity and manufacturer authorization before engaging.

- Confirm live stock with dated evidence (photo, screenshot, or emailed stock confirmation).

- Lock price and quantity with a PO or short-term contract and require an expiry date on quotes.

- Request inspection, date-code traceability, and COA for critical or high-volume orders.

- Plan logistics: split shipments, insure high-value freight, and include clear cancellation/return clauses.

Summary

Actionable takeaway: before issuing a PO for this Rosenberger panel jack, verify live stock counts with dated evidence (one listing shows 4,557 pcs), confirm landed price and written quote terms (public quotes ~ $26.69–$29.26), and follow the verification workflow plus the procurement checklists above to minimize risk and reduce lead time for US deliveries.

Key Summary

- Verify timestamped inventory and packaging photos—match seller SKU, quantity, and date-code to RFQs to avoid mismatch and counterfeit risk.

- Collect written quotes showing unit price, MOQ and landed cost; compare domestic vs offshore fulfillment for lead-time impact.

- Prioritize authorized sellers with traceability; for brokers require COA, dated photos, and explicit return/inspection terms before payment.

FAQ

How can a US buyer verify stock for this part quickly?

Request a dated screenshot or emailed inventory confirmation from the seller, plus photos showing part quantity and packaging with a visible date code. Favor sellers who provide COA or traceability and who will commit to a short quote expiry; document all communications to support the PO.

What should I ask sellers about price and shipping for the part?

Request the unit price, MOQ, bulk pricing tiers, and a landed-cost breakdown (shipping, duties, insurance). Ask for lead times from the stated warehouse and expedited shipping options; insist the quote include expiry date and payment/return terms to avoid post-PO price changes.

When is it acceptable to buy from a broker rather than an authorized distributor?

Use a broker only for short-term needs when authorized stock is unavailable and the broker provides dated photos, COA/serial traceability, and a clear returns policy. For production-critical buys, prefer authorized distributors to ensure warranty, traceability, and lower counterfeit risk.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- APT50GH120B Datasheet Deep Dive: Specs, Ratings & Curves

- APT50GH120BSC20 Power Module: Latest Performance Report

- APT50GH120BD30 IGBT: How to Maximize Efficiency for EV Drive

- GTSM20N065: Latest 650V IGBT Test Report & Metrics

- CMSG120N013MDG Performance Report: Efficiency & Losses

- GTSM40N065D Technical Deep Dive: 650V IGBT + SiC SBD

- NOMC110-410UF SO-16: Live Stock & Price Report

- 1757255 MSTBA 5.08mm PCB: Step-by-Step Install & Solder

-

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606 -

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606 -

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606 -

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606 -

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606 -

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606 -

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606 -

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606 -

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606 -

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606