-

- Contact Us

- Privacy Policy

- term and condition

- Cookies policy

08S121-270S3 Datasheet & Obsolescence Report — Latest

Lifecycle monitoring services show a sustained double-digit increase in obsolescence alerts year-over-year — making a timely review of the 08S121-270S3 datasheet essential for OEMs and repair houses. This article provides a concise datasheet snapshot, a data-backed obsolescence assessment, vetted replacement candidates, and actionable procurement and lifecycle steps to reduce supply risk and support field service readiness.

The intent is practical: present key electrical and mechanical parameters, interpret channel and distributor indicators for an obsolescence report, and recommend immediate mitigation (authorized stock checks, last-time buy calculations, and shortlist testing). Technical teams will find parametric guidance and procurement checklists tailored for US OEM workflows.

1 — Background & Quick Specs: 08S121-270S3 datasheet snapshot

1.1 Key specifications at a glance

- Part number: 08S121-270S3

- Manufacturer / product family: manufacturer connector family (see official datasheet)

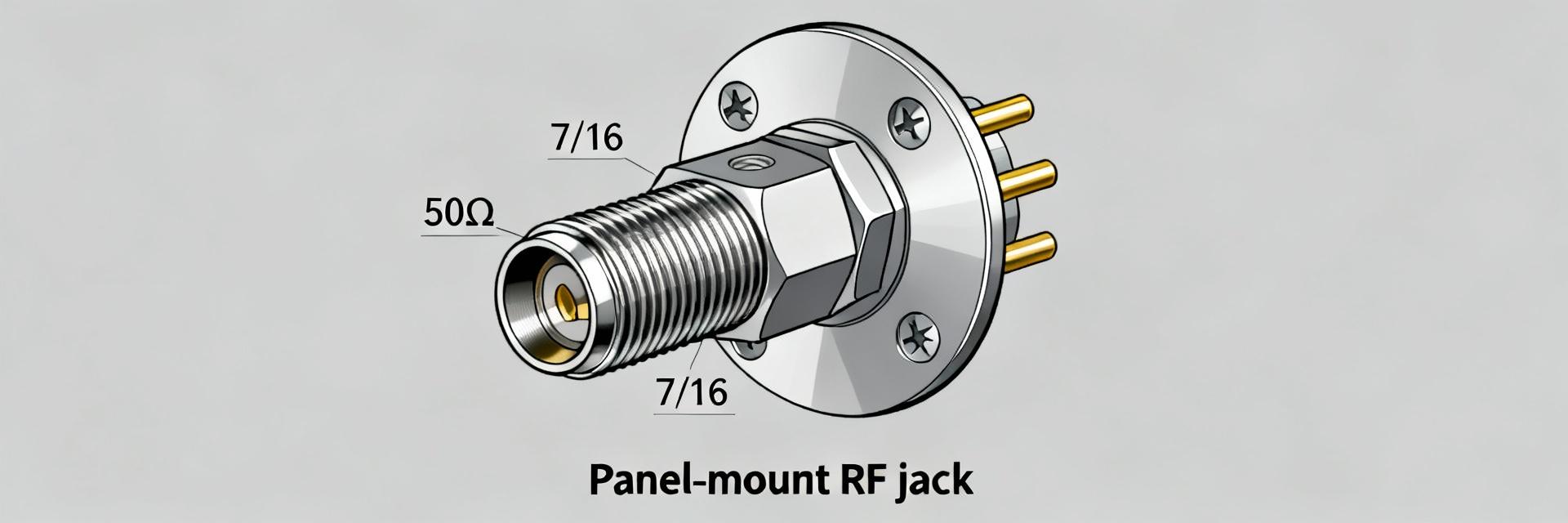

- Function: RF/coaxial interconnect

- Package: panel-mount coax connector, solder/jack options

- Electrical ratings: 50 Ω impedance, typical voltage rating and current per datasheet tables

- Key performance: insertion loss, VSWR at specified frequencies (see performance curves)

- Temperature range: industrial operating range per spec

- Pinout summary: single coax contact, standard mating interface

- Typical applications: RF testing, telecom, instrumentation

Highlight: three specs likely to drive obsolescence are custom packaging variants, any proprietary insulating materials, and firmware/encapsulation steps tied to specific product families. Verification against the official datasheet excerpt avoids BOM mismatches during procurement.

1.2 Part marking, ordering codes & packaging notes

Ordering typically uses base part plus suffixes for finish, mating orientation, and packaging (reel/tray/each). Sample ordering codes follow the pattern: base-part[-suffix][pack-code]. Common BOM mistakes include omitting finish suffixes, confusing mating variants, and assuming reel packaging for small-quantity orders. Minimum order quantities and special labeling (date codes, lot IDs) can affect cross-references during aftermarket buys; confirm packaging notes on the official datasheet before issuing POs.

2 — Lifecycle & Obsolescence Summary: current status and history

2.1 Current lifecycle state and EOL/NRND indicators

Public lifecycle signals for this connector line are primarily visible via manufacturer datasheet revisions and authorized channel stocking alerts. If no explicit EOL/NRND notice exists, rising lead times, diminished safety stock, and intermittent distributor delists are practical EOL indicators used in any obsolescence report. Teams should record last manufacture and last recommended buy dates from the manufacturer bulletin and watch for sustained lead-time growth as a trigger for LTB planning.

2.2 Historical trend & risk drivers

Observed trends over recent years include occasional raw-material-driven lead-time spikes and introduction of newer connector families that shift OEM demand. Risk drivers: specialized insulators or plating that become constrained, consolidation of production, and regulatory changes affecting materials. A simple risk score: Medium — justified by intermittent stock volatility, modest demand taper, and no published global EOL notice. Recommended graph: years vs. available stock and lead time to visualize the trend for executive review.

3 — Detailed Datasheet Breakdown: electrical, mechanical, and test data

3.1 Electrical and performance characteristics to verify

Critical electrical tables to capture from the 08S121-270S3 datasheet include absolute maximums, recommended operating conditions, insertion loss vs. frequency, and VSWR/TDR performance. Call out test conditions (temperature, measurement fixture, cable type) and measurement tolerances. Any non-standard test setup or calibration reference must be noted so lab validation matches datasheet curves. Teams should reproduce IV/timing equivalents and key S-parameter plots during qualification.

3.2 Mechanical drawings, thermal and reliability data

Mechanical dimensions, mounting hole patterns, and recommended torque values must be transferred precisely into CAD and footprint libraries. Thermal notes (if any) and suggested derating factors for harsh environments should be documented. Verify reliability qualifications—environmental stress screening, MTBF estimates, and applicable qualification standards—and include a PCB integration checklist: footprint clearance, mating access, and mechanical support for panel-mounted installations.

4 — Obsolescence Risk Assessment & Alternatives

4.1 Cross-reference and direct-fit replacement candidates

Parametric searches should match pin-to-pin compatibility, impedance, package/mechanical footprint, and electrical performance. Shortlist 2–3 candidates that are direct-fit or near-fit and note qualification gaps. For example: Candidate A (direct-fit) — strong stock, similar VSWR but different plating; Candidate B (near-fit) — requires minor panel redesign but better availability. Document pros/cons, required requalification tests, and any mechanical adapters needed. Use the obsolescence report to prioritize candidates for drop-in test.

4.2 Lifecycle extension tactics: last-time buys, redesign vs. drop-in swaps

Evaluate LTB economics using expected annual usage, field repair rate, and safety stock. Example LTB calc: LTB quantity = (expected production units for lifecycle horizon) + (expected repair spares) + safety factor (typically 20–50%). Compare LTB cost vs. redesign cost and time-to-market; redesign is preferred when long-term availability is uncertain or when alternatives reduce qualification burden for future programs.

5 — Procurement & Lifecycle Management Best Practices (for US OEMs)

5.1 Sourcing checklist & authorized channel validation

Procurement checklist: verify part against the official manufacturer datasheet and ordering codes, confirm authorized channel status, require certificate of conformance and lot traceability, and perform counterfeit risk checks. Conduct on-site or remote supplier audits for critical buys. Maintain documented authorized-supplier lists and require serialized lot traceability for spares destined for field service.

5.2 BOM management and proactive lifecycle monitoring

Integrate lifecycle alerts into PLM/ERP workflows and set thresholds: lead time > 26 weeks, stock

6 — Compliance, Testing & Field Support Considerations

6.1 Regulatory and compliance checks (RoHS, REACH, safety)

Validate RoHS/REACH declarations and any applicable safety approvals against the datasheet. Common procurement pitfalls include accepting a lot without updated compliance declarations after material changes. QA should flag non-compliant lots, require supplier corrective actions, and quarantine suspect inventory until conformance is established via documentation.

6.2 Field failure modes, test procedures & repair guidance

Common failure signatures include increased VSWR, intermittent contact, or mechanical loosening. Recommended tests: continuity, VSWR sweep, and mechanical torque checks. Use simple isolation tests to distinguish connector versus cable failures. For repairs, document rework steps, acceptable refurbishment tolerances, and when replacement is required for safety or performance reasons.

Summary

- 08S121-270S3 datasheet review: capture electrical curves, mechanical footprints, and ordering suffixes to avoid BOM errors; validate against the official manufacturer datasheet before procurement.

- Obsolescence report conclusion: current risk = Medium based on lead-time volatility and limited stock signals; prioritize authorized stock verification and consider an LTB if production depends on legacy units.

- Immediate actions: verify authorized stock, perform an LTB calculation using projected production and repair rates, and bench-test 2–3 shortlisted replacement candidates for drop-in compatibility.

- Lifecycle next steps: integrate lifecycle alerts into PLM/ERP, set lead-time and stock thresholds, and schedule quarterly BOM reviews with engineering and procurement stakeholders.

FAQ — What is the recommended first step when an obsolescence report flags the 08S121-270S3?

First, confirm the manufacturer’s current datasheet and any official lifecycle notices. If no EOL notice exists, verify authorized channel stock and recent lead-time trends; if lead time or stock is below your thresholds, run an LTB calculation and initiate sourcing for vetted replacements.

FAQ — How should a team size a last-time buy for this connector?

Estimate total units for the product lifecycle horizon, add expected repair/spare demand, and include a safety factor (20–50%). Example: annual production 5,000 units × remaining years 3 = 15,000, plus 500 repair spares and 20% safety → LTB ≈ 19,800 units. Adjust for budget and storage constraints.

FAQ — What tests are essential when qualifying a replacement for the 08S121-270S3?

Essential tests: mechanical fit and torque, electrical: VSWR and insertion loss across the operational band, environmental stress screening per application, and contact resistance checks. Match test conditions to the original datasheet measurement setup to ensure comparable results.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- APT50GH120B Datasheet Deep Dive: Specs, Ratings & Curves

- APT50GH120BSC20 Power Module: Latest Performance Report

- APT50GH120BD30 IGBT: How to Maximize Efficiency for EV Drive

- GTSM20N065: Latest 650V IGBT Test Report & Metrics

- CMSG120N013MDG Performance Report: Efficiency & Losses

- GTSM40N065D Technical Deep Dive: 650V IGBT + SiC SBD

- NOMC110-410UF SO-16: Live Stock & Price Report

- 1757255 MSTBA 5.08mm PCB: Step-by-Step Install & Solder

-

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606 -

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606 -

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606 -

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606 -

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606 -

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606 -

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606 -

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606 -

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606 -

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606